What is the Employee Retention Credit?

Employee Retention credits are fully refundable tax credits for employers which equal a certain percentage of qualified wages that eligible employers pay to their employees. This credit is part of the CARES Act in 2020.

Recently, as part of a COVID stimulus bill passed in Dec. 2020, employee retention credits have been continued into 2021 and will now be calculated with up to 70% (previously 50% in 2020) of qualified wages on a per quarter basis.

Looking to learn more? Check out the IRS's FAQ: https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act

This article includes:

- Tracking Employee Retention Credit Notes

- Employee Retention Pay Codes

- Employee Retention Credits & Reporting

Tracking Employee Retention Credit Notes

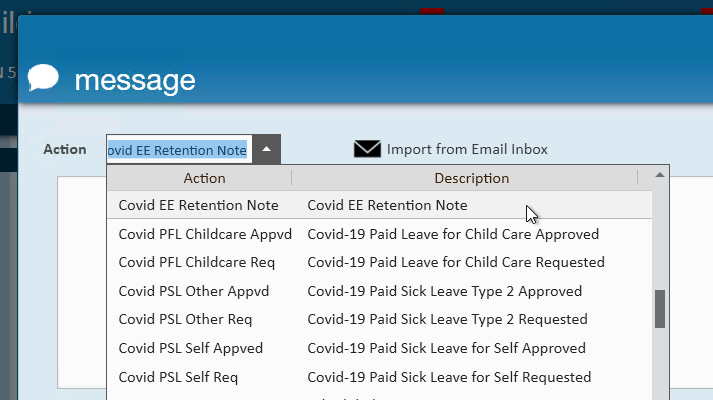

To track which employees are being marked for Employee Retention credits, you can utilize a message action code to document retention notes in your system.

The new message action code is titled: "Covid EE Retention Note"

Check out Tips for Message Logging for more information on logging messages.

Employee Retention Pay Code

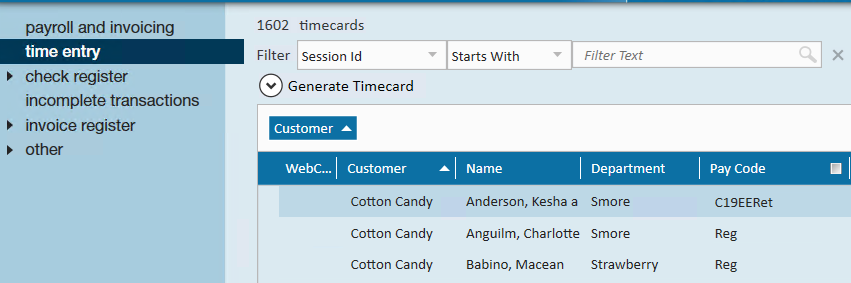

If you need to track which employee wages are related to the employee Retention Credit, you can utilize the C19EERet Pay code in Time Entry

*Note* Our system will not inform your team if you qualify for employee retention credits or how much total payroll you can utilize for employee retention credits.

Please check out the IRS guidelines: https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act and consult your tax professionals for more information.

If your employee reaches a total amount over $10,000 using the C19EERet, you will see a proofing and payroll error letting your payroll processors know.

Employee Retention Credits & Reporting

If you track Employee Retention Credits using the C19EERet pay code, you will see employee retention credit amounts on COVID reporting: COVID Reports Manual.