This release brings a fresh look to Beyond, Rapid! PayCard Instant Funding, Flexible Payment Methods in Enterprise, CA Pay Transparency report updates, along with plenty of fixes and improvements across TempWorks products.

*Note* For all self-hosted clients, as always, ensure you install all updates to give your users the best experience and new features.

The Highlights

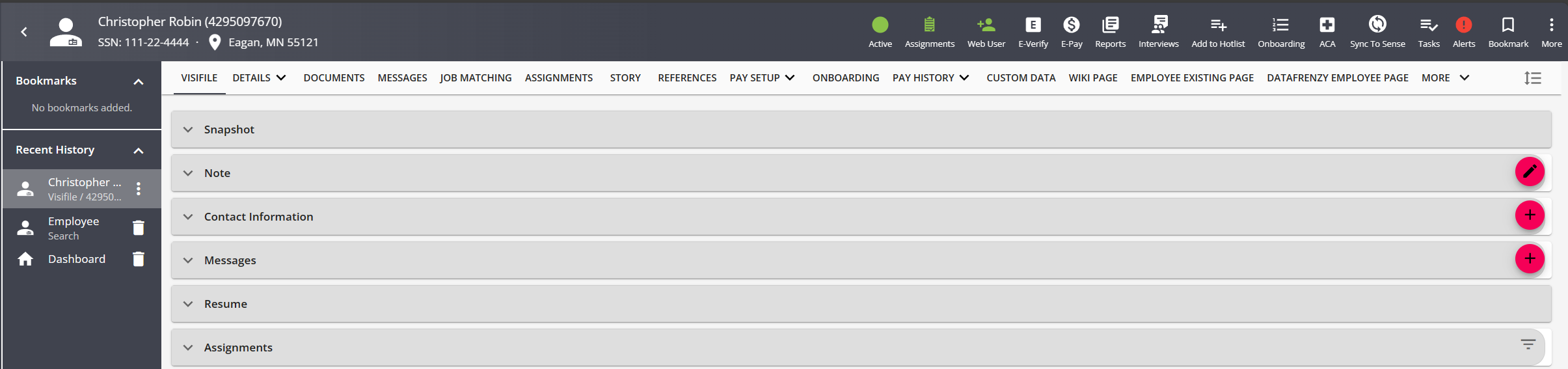

| Beyond UI/UX ImprovementsOn 4/19/2024, Beyond is getting a fresh coat of paint! The improved Beyond UI/UX comes with the following enhancements:

*Note* Once the UI/UX refresh has been released, your Charms will need to be re-ordered based on your preferences.

You will be able to select up to 12 charms to view within the header. Attempting to select more than 12 will prompt a message stating, "Maximum number of charms reached". *Note* For more information on the overall improvements, please see the article titled Beyond - UI/UX Improvements Overview. |

| Rapid! Paycard Instant Funding & Flexible Payment MethodsTempWorks Enterprise™ and Beyond™ both integrate with Rapid! PayCard to activate/register paycard information and instant fund paycards for your employees. With the Flexible Payment Method functionality, the payroll clerk can temporarily overwrite the employee's default payment method for each check in a given payroll run. *Note* For more information, please see the following articles: |

CA Pay Transparency Report UpdatesTo support additional compliancy for California Pay Transparency, the following functionality has been added:

*Note* For more information on this report, please see the article titled CA Pay Transparency. | |

Removal of TempWorks Support Live Chat functionality from EnterpriseEffective 4/19, we will be upgrading our current live chat integration. While this upgrade will bring more robust tools and analytics that allow us to better serve our clients, this functionality will no longer be integrated directly in Enterprise. To initiate a live chat post 4/19, please follow these instructions:

|

Additional Updates

In Beyond

- Fixed an issue preventing Microsoft 365 email credentials from being saved.

In Enterprise

- Fixed an issue preventing the uploading of a required document.

- Fixed an issue where an arrear would not be removed after removing a check from a payroll run that was past the calculation stage. Now, regardless of whether the payroll run is abandoned, once the check has been removed from the payroll run, the arrear will also be removed.

In Reports

- Extended the Payroll Journal “Electronic Pay” grouping to include the following:

- Not Electronic Pay

- ACH Bank Account

- Paycard Instant Funding

Tax Updates:

- Completed the following tax updates:

- Kentucky

- For Buckhorn, KY - Added a new tax with a rate of 1%.

- For Hartford, KY - Added a new tax with a rate of 1%.

- For Henderson, KY - Added a new tax with a rate of 1.65%.

- For Jackson, KY - Added a new tax with a rate of 1.85%.

- For Jeffersonville, KY - Updated the tax rate to 2%.

- For Lebanon Junction, KY - Updated the tax rate to 1.5%.

- Ohio

- For Apple Creek East Union Twp JEDD II - Added a new tax with a rate of 1%.

- For Willard, OH - Updated the tax rate to 1.75%.

- New Mexico

- Completed Sales Tax updates per the requirements of New Mexico.

- Pennsylvania

- For Hazelton, PA - Decreased Non-Resident Rate to 1.5% and decreased Resident Rate to 1.125%.

- For Homestead Boro, PA - Updated the Non-Resident rate to 1%.

- Washington

- Completed tax updates per the requirements of Washington.

- Kentucky

Congratulations! You've made it to the end of the release notes. Like what you read? Click the thumbs up below.

Related Articles

- None