Child Support from TempWorks Software on Vimeo.

Quick Steps

- Navigate to the Employee Record that requires the child support adjustment and expand the pay setup section and select adjustments

- Select the + icon to add a new adjustment

- Select the childsupport adjustment from the Adjustment dropdown (Note that only one of each adjustment type can be used for an employee so if you have someone that requires multiple child support adjustments use childsupport1, childsuppoort2, etc.)

- Optionally, add a description (ex. child's name)

- Under Frequency, use the drop down to select the frequency that the employee is paid (daily, weekly, etc.)

- Optionally, if the start date is later than today's date, enter a date. Otherwise, leave blank to start the adjustment immediately.

- Select the Authority from the drop down

- Enter the case number and select next

- Enter the adjustment rule (either amount or % of paycheck) and Set a Maximum Deduction

- Select Save

- If the employee already has some adjustments, be sure to update the sequence number

- Enter the period max and Select Save

Complete and Detailed Steps

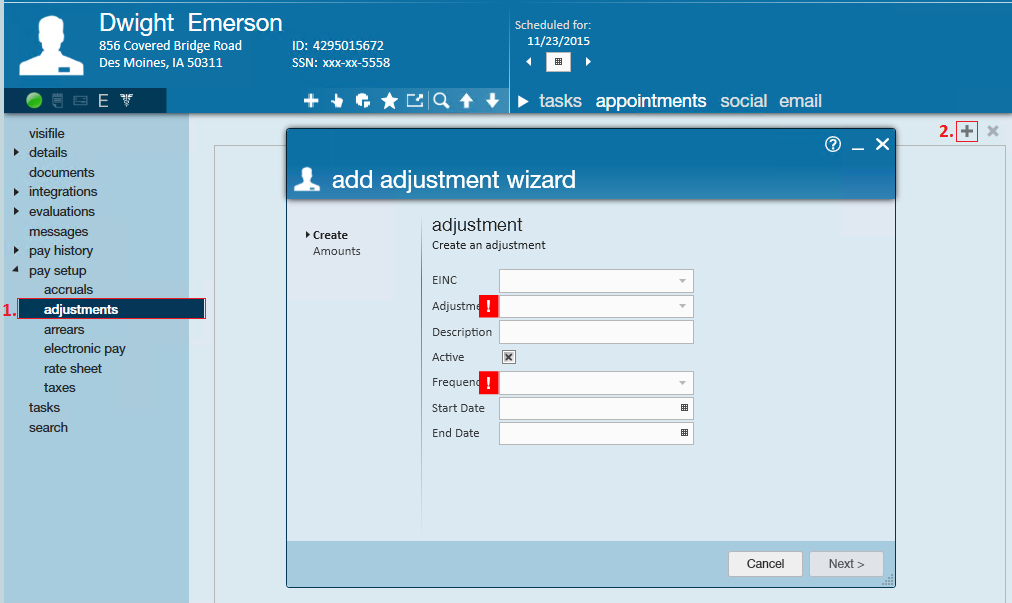

Begin by navigating to the employee's record → expand the pay setup section → select the (1.) adjustments page. Once there, click the (2.) + icon to open the "add adjustment" wizard.

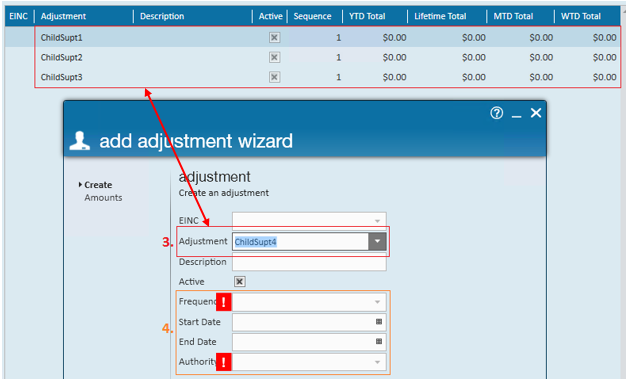

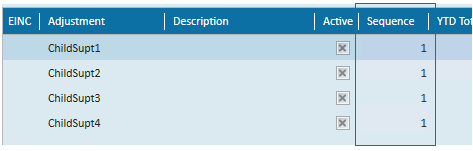

In this example and the image below, the adjustments page shows that ChildSupt1, ChildSupt2, and ChildSupt3 have already been added to this employee's record. This is important because the same adjustment cannot be added more than once per record. So if this employee receives a fourth order we'll select (3.) ChildSupt4 from the adjustment dropdown.

*Note* If the child support adjustment which is needed is not listed in the adjustment dropdown, it can be added in the administration section of Enterprise. If you do not have access to Enterprise administration, see your manager for assistance.

The (4.) frequency and authority fields are listed as required:

- Frequency: Should always match the frequency with which you pay the employee - daily, weekly, bi-weekly, semi-monthly, or monthly.

- Authority: The entity that will be receiving the employee's garnished wages. Ex. Minnesota Child Support Agency.

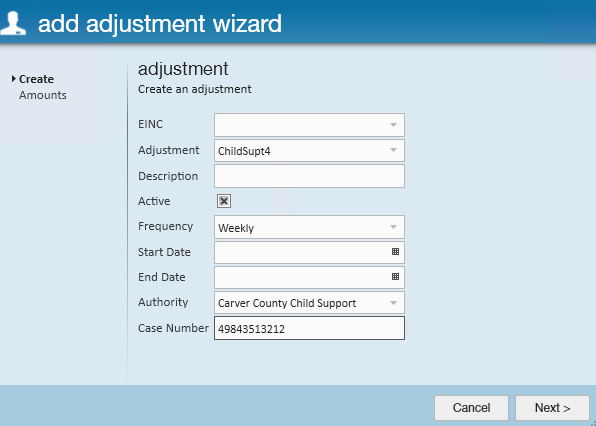

Once you have completed filling out the basic adjustment information, select next to continue.

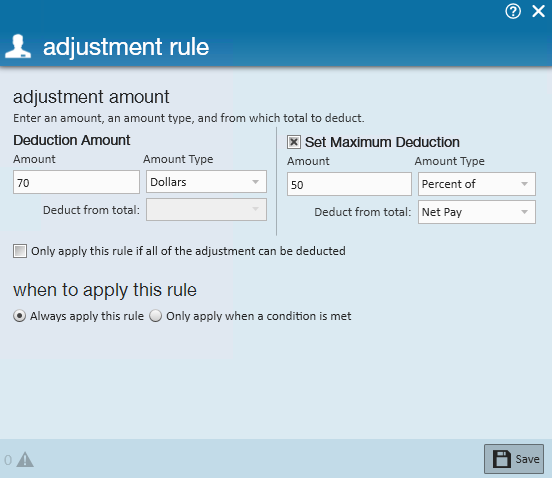

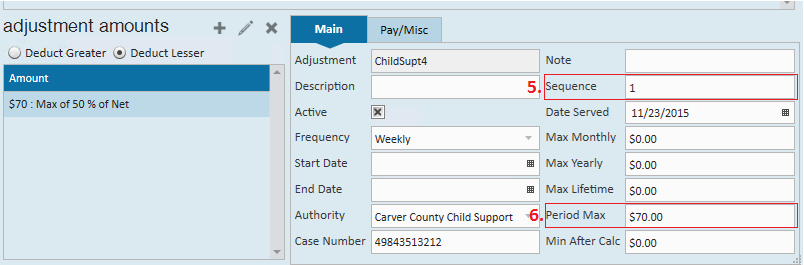

This brings us to the adjustment rule page where users define the exact deduction amount and any directives included with the child support garnishment.

Following our example, we are stating that this employee is to have $70.00 garnished weekly, but we are never to take more than 50% of their net pay:

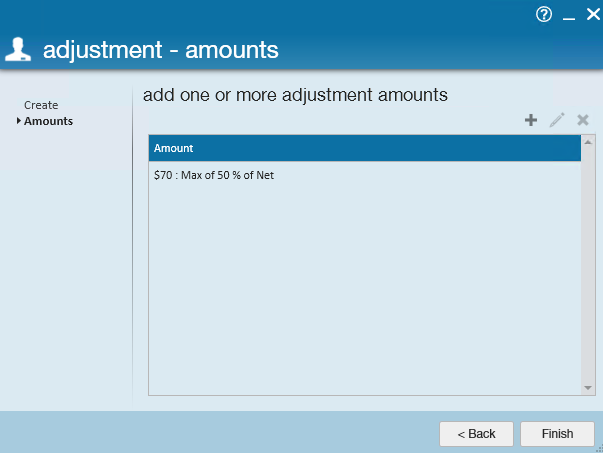

Upon selecting save users will be brought to the final page in the wizard to review the garnishment. Users can edit the garnishment by clicking the pencil icon, or, if the setup looks correct, select finish to officially add the garnishment and exit the wizard.

With the new garnishment added, confirm the (5.) sequence and (6.) period max in the detailed adjustment.

Why Enter a Sequence?

When an employee has multiple adjustments setup on their record, how does Enterprise know which adjustment to garnish first and which to garnish last? Sequence! The sequence determines the priority of an employee's adjustments.

For example, the image below shows an employee that has multiple child support adjustments added. Does ChildSupt1 get first priority, and ChildSupt2 second priority, and so on? No!

Each child support garnishment is equally important (has equal priority), so they should all be given the sequence of 1. When the employee is paid, Enterprise will look at the employee's wages and as equitably as possible distribute the earnings amongst the four adjustments.

After sequence 1 adjustments are calculated if the employee has garnishable wages remaining Enterprise will then move on to any adjustments with a sequence of 2. This process will continue automatically until either the employee has no garnishable wages left or all adjustments have been fulfilled.

Why Enter a Period Max?

Enterprise adjustments are tracked by weekend date. So for example, let's say our employee turns in a timecard with 40 hours on it for the weekend date 11/22/2105. That timecard is processed by payroll and the full $70.00 is garnished. Now, imagine if the employee turned in an additional timecard for the weekend date 11/22/2015 with 8 hours of additional overtime.

Processing that second timecard without a period max would garnish the employee's wages a second time. By adding a period max we prevent Enterprise from double dipping into the same period. This way, the employee will never be over garnished.