Version ∞2017.11.3

Enterprise

New:

- Added a new optional CSV type mag media file for Georgia. This is in addition to the default GA ICESA file and will need to be setup by TempWorks Support in order for you to see this addition.

Improvements:

- Optimized the uMergeAident procedure that is used when merging employee records. Transactions will no longer be merged unless “Update Assignments and Transactions” is selected in Enterprise.

- Increased performance in the Data Integrity Check to reduce load times and prevent crashing issues. Also updated Error #6 to state, “There are employees with year-to-date wages that do not match the year-to-date wages on the checks. Please review and contact TempWorks Support for assistance.”

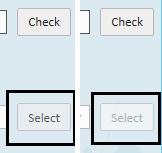

- Made buttons that appear disabled appear more like that they are disabled. Below are images that were taken from the manage web user account area. Old is on the left and new is on the right.

Fixes:

- Fixed the Date/Time field in the message details of messages created from ZipWhip texts.

- In a situation where a check had a secondary direct deposit that was epay, but the primary check was live, the secondary direct deposit would display as live on the Payroll Summary report. The secondary deposit in this situation will now display as epay.

- Fixed an obscure bug on the data grid in time entry.

WebCenter

Improvements:

- Users will be brought to the home page when signing into WebCenter or impersonating an employee/contact/vendor.

Fixes:

- Vendors editing employee info will no longer receive an error when updating SSN.

Taxes

New:

- Three OH Locals Added to CCA Collection Member List:

- Hamilton

- New Miami

- Phillipsburg

- Added a Geoloc entry for zip code 43062 Etna, OH.

- Elmore, Fayette, West Lafayette, and Wickliffe OH are now administered by RITA

- Added Lancaster, Kentucky with a rate of .5%

Rate Changes:

- Pennsylvania

- Bridgewater Boro increased non-resident tax rate from .50% to 1.00%.

- New Mexico

- Rio Rancho sales tax now 7.4375%

- California

- San Francisco decreased employer rate from .829% to .0711%

- Indiana

- LaGrange County changed rate to 1.65%

- Marion County changed rate to 2.02%

- Sullivan County changed rate to .6%

- Vermillion County changed rate to 1.5%

- Allen County Resident and Non Resident rate from 1.35% to 1.48%

- Clinton County Resident and Non Resident rate from 2.00% to 2.25%

- Fountain County Resident and Non Resident rate from 1.55% to 2.10%

- Kentucky

- Olive Hill, Carter County changed rate to 1.5%

- Garrard County percentage rate from 1.50% to 2.00%

Fixes:

- Users will no longer receive an error stating “Ambiguous column name 'exempt wages'” when generating a mag media file for VA.

- Updated the tax method for West Virginia taxes to be weekly because they are weekly taxes.

HrCenter

New:

- Added an optional field to the registration page to prompt for a phone number; the phone number will postfill to the employee record when completed. This feature can be setup to be enabled, disabled, or required in HrCenter Admin.

Beyond

Fixes:

- Fixed a bug that was causing an error if attempting to sort by the resume column.