What is an Accrual?

In Enterprise Core, you can track and manage customized accrual packages. This allows you to track accruals as well as deduct any vacation or PTO which has been paid out. Each employee will have an ongoing accrual amount which can be modified as needed allowing for excellent flexibility, reliability and usability.

In order for your team to utilize accruals, your custom accrual package options must first be created in administration.

Creating an Accrual in Administration

To create a new accrual package, navigate to Administration > Accruals and select the + icon.

Fill out the following information:

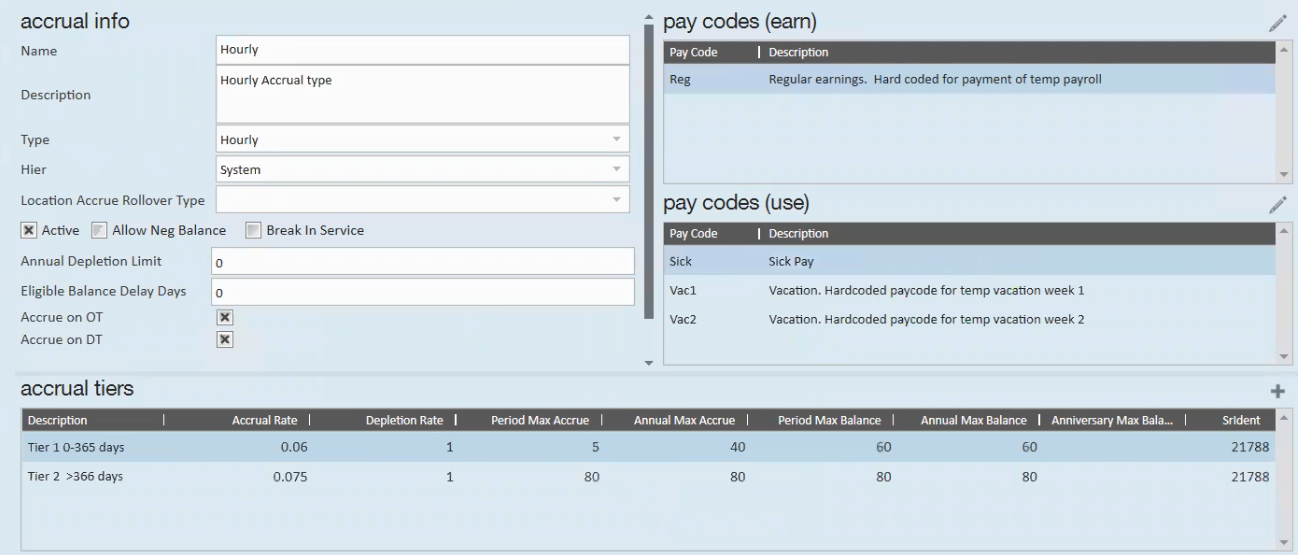

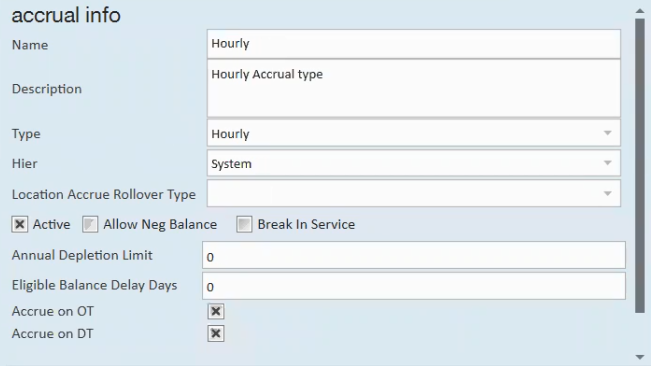

Accrual Info

- Enter a name for the accrual type

- ex. Vacation or 0-1 years

- Optionally, enter a description to help identify the accrual

- Select the type of accrual:

- Anniversary: This is a lump sum of hours. Anniversary date is set by the system (daily maintenance) based on the Monday of the first week ending date for which they are paid. We do not recommend manually editing the anniversary date.

- Annual: This is a lump sum of hours given for the time frame of January 1st-December 31st.

- Hourly: Employee accrues X number of hours per hour worked.

- Pay Period: Employee accrues X number of hours per pay period worked.

- Select a Hier

- Hier is short for hierarchy. Here you should select the level of hierarchy that you want this accrual to apply to.

- Ex. Entity level = All records under that entity.

- Unsure about hierarchy? check out Core - Hierarchy article for more information.

- Active Check Box

- This box must be checked in order to use the accrual type.

- If later, accrual policies change or packages are updated, you can uncheck this box to deactive the accrual.

- Allow Neg Balance Check Box

- Check this box if you want to allow a negative balance for this accrual type.

- Break In Service Check Box

- Check this box if you want to utilize the Break In Service functionality.

*Note* For more information on the Break In Service functionality, please see the article titled Accruals - Break In Service.

- Optionally, enter an amount under Annual Depletion Limit

- When used, this amount limits how many hours of an eligible balance can be used yearly

- Optionally, enter an amount under Eligible Balance Delay in Days

- When used, determines when the accrued hours are eligible to be used.

- Optionally, select whether or not the accrual accrues on OT (overtime).

- Optionally, select whether or not the accrual accrues on DT (doubletime).

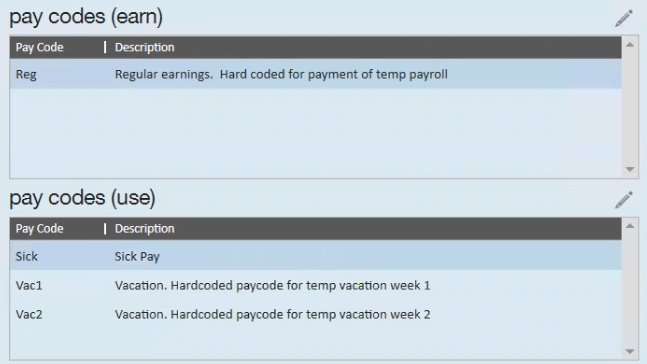

Pay Codes Used and Earned

- Select the

icon to see a list of all pay codes that can be used or earned

icon to see a list of all pay codes that can be used or earned - Pay Codes (Earned)

- When the pay code(s) selected in this section are used on transactions in time entry, this accrual will be earned (if setup on the employee record).

- Typically, this is the reg pay code.

- Pay Codes (Use)

- When this pay code is used on transactions in time entry accrued time will be depleted.

- Typically, this would be Vac1, Vac2, Sick, or Hol.

*Note* Multiple types of pay codes may be selected for both pay codes (earn) and pay codes (use).

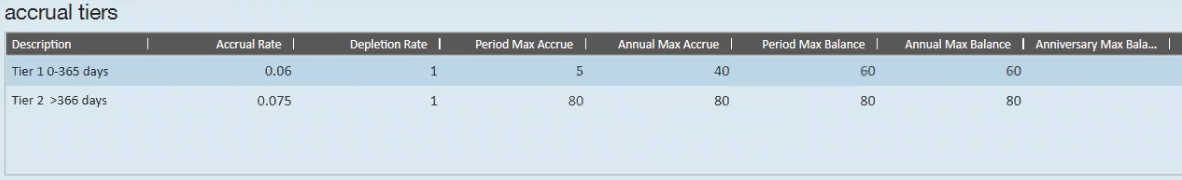

Accrual Tiers

This section allows users to setup multiple rules that exist for an accrual. This can be used to setup a accrual package that changes rates over time. For instance, if an employee's rate changes from 2.8 hours per period to 4.9 hours after one year with the company.

Select the + icon to add an accrual tier.

Fill out the following information:

- Description: Used to define and distinguish accrual tiers (especially helpful when multiple tiers are being established).

- Accrual Rate: The rate at which the accrual is earned, this is directly related to the pay codes (earn). For accrual's with the type of pay period the rate should reflect how much time is accrued after the completion of a pay period. For accruals with the type of hourly this should reflect how much time is accrued per hour worked.

- Accrual Rate Example: If pay code (earn) is set to reg, and the accrual rate is set to 0.05, that means if an employee works 40 hours that week, they've accrued 2 hours for that week (0.05 * 40 = 2).

- Depletion Rate: The rate at which the accrual is used, this is directly related to the pay codes (use). Typically this is set to "1".

- Depletion Rate Example: If pay code (use) is set to Sick, and an employee uses one sick day, in time entry, that would be keyed in as 8 RT hours with the pay code sick. The 8 hours would then be deducted from the employee's accrual balance so long as the depletion rate was set to 1.

- Period Max Accrue: The maximum amount of time that may be accrued in a given pay period. This is usually similar if not the same as the rate when the accrual type is pay period. When the type is hourly take into the account the maximum hours an employee is allowed to work. Something to consider is if employees can accrue on OT, you will want the period max accrue to be greater than the accrual rate * 40 . and the annual max accrue to be greater than accrual rate * 40 * 52.

- Annual Max Accrue: The maximum amount of time that may be accrued in a given year. For the accrual type of pay period this can be calculated with the simple formula of (rate* pay periods per year). For hourly this can be the upper limit of how much can be accrued per year.

- Period Max Balance: The maximum amount of time that may be held by an employee at the end of a period. This usually will be the same as the annual max balance and anniversary max balance. In some cases you may allow this balance to be higher than your max balance annual and anniversary If you allow your employees to exceed a max balance but do not let those hours carry over to the end of the year or anniversary.

- Annual Max Balance: The maximum amount of time that may be held by an employee at the end of a year. This usually will be the same as the period max balance and anniversary max balance.

- Anniversary Max Balance: The maximum amount of time that may be held by an employee at the end of their anniversary year. This usually will be the same as the annual max balance and period max balance.

*Note* When making edits to Accruals within Enterprise Core Administration, the tiers for the Accrual on the Employee record will not be automatically updated. The Accrual Tier will need to be reassigned to the Employee record for the new information to take hold.

icon to see a list of all pay codes that can be used or earned

icon to see a list of all pay codes that can be used or earned