There are many instances where an employee has been paid, and that payroll includes an adjustment. If an adjustment was setup with an incorrect authority or if the authority has been changed, a fix is possible.

This article will walk users through the steps involved in making this type of update.

Step 1: Review the Employee's Check

Within the employee's check summary, we can see that a (1.) child support adjustment deducted $75.00:

To update the authority associated with the check, navigate to the adjustments page of the employee's record. Following our example, the ChildSupt1 adjustment shows the current associated authority is (2.) Dakota County Child Support.

Step 2: Update the Authority on the Adjustment

Expand the dropdown and select the (3.) new, correct, authority.

*Note* If the authority for this adjustment is not listed in the dropdown, that means it will need to be added in the administration section of Enterprise. Please see your office's Enterprise Administrator to assist in adding the authority. See How to Add Authorities for more information.

Once the change has been made, select the save icon to confirm your update.

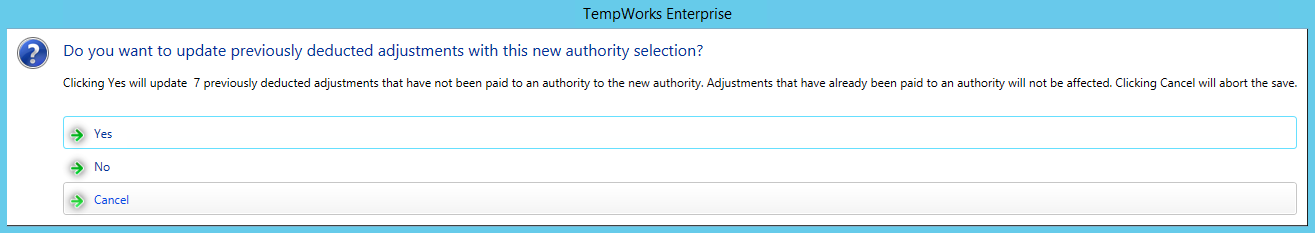

The prompt "Do you want to update previously deducted adjustments with this new authority selection?" will automatically display if the employee has been paid but the authority check has not yet been created.

Additionally, the statement "Clicking Yes will update x# of previously deducted adjustments that have not been paid to an authority to the new authority. Adjustments that have already been paid to an authority will not be affected. Clicking cancel will abort the save." displays.

Following our example (below), this is stating that there are seven checks which have been paid to our employee, but the adjustment's associated authority does not yet have a check. So when an authority check is created for this adjustment, it will not only associate this new authority to checks going forward, but it will also retroactively associate this new authority with the employee's other seven checks.

Step 3: Pay the New Authority

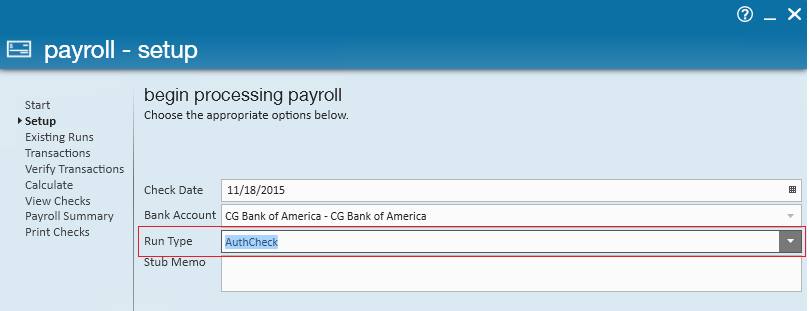

Select a run type of AuthCheck to create a check to authorities.

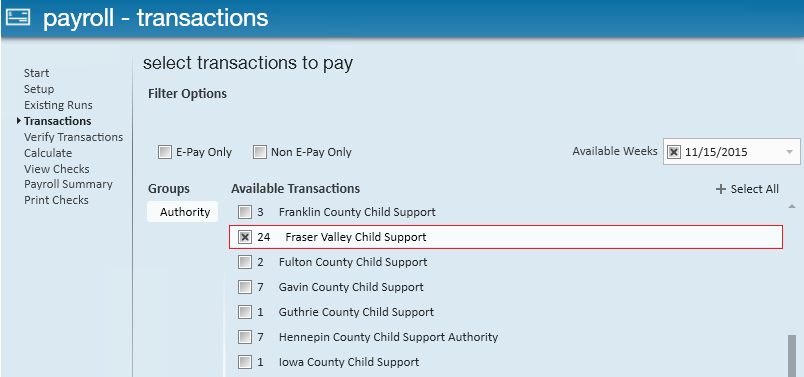

Following our example, within the transactions step of the payroll run the authority "Fraser Valley Child Support" has been selected.

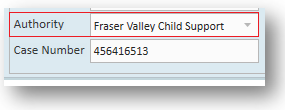

Note that there are seven transactions total associated with the case number 456416513 - this matches our example adjustment from the employee record (outlined earlier in this document):

When payroll is processed all seven transactions will be associated with the new authority, Fraser Valley Child Support, instead of the old authority, Dakota County Child Support.