What is a Vendor?

There are two basic types of vendors:

- Subcontractor Vendors - These are 3rd party staffing agencies or other providers that are sending their employees to fill some of your orders. Because these employee's do not belong to your staffing agency, the payroll for these people will be consolidated into a payment to the agency. The agency is then responsible for paying and preparing tax documents for their employees. Check out Vendors - Subcontractors in Enterprise for more information.

- Independent Contractors (1099 Employees) - These individual employees are registered as independent contracts. Your staffing company pays the employees but the employees will be responsible for their own taxes. Instead of receiving a W-2, these employees will receive a 1099 form.

In both cases, the client is not responsible for the taxes of the 1099 employee or employees of the 3rd party staffing company.

*Note* Within Enterprise, the difference between 1099 employees and staffing agencies is something called a "Pseudo AIdent." Staffing agencies have one; 1099 employees do not.

This article covers:

- Creating a 1099 Vendor Record

- Linking the Independent Contractor Employee Record

- 1099 Payroll Overview

Creating a 1099 Vendor Record

In order to classify the independent contractor as a 1099 employee. You will need to create a Vendor record for them. In this case, the vendor record will be set up with a one to one relationship meaning one vendor record for one independent employee. This will allow the employee to receive a 1099 form at the end of the year instead of a W2.

To Create a New Vendor Record:

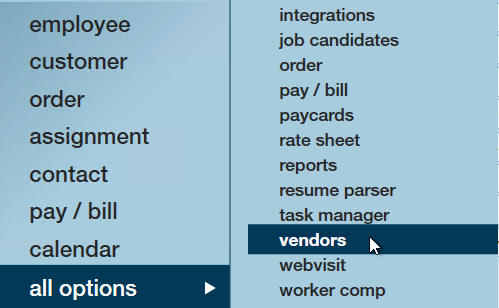

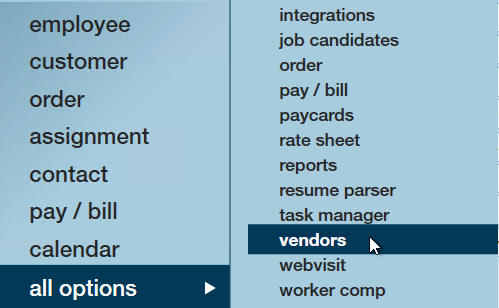

- In Enterprise, Navigate to All Options > Vendors

- Select the + in the upper right

- Enter the following information:

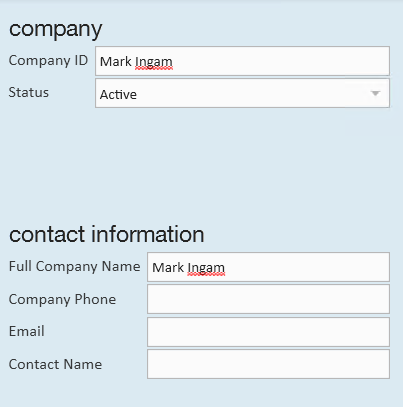

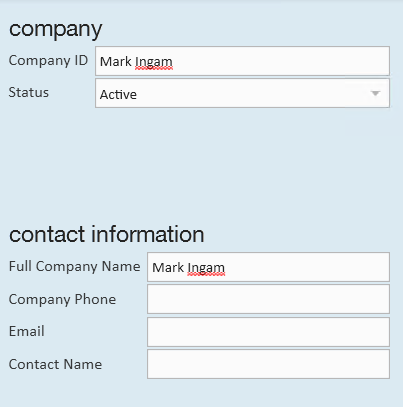

- Company and Contact information:

- *Company: The Independent Contractor's company name as you want it displayed in your system (usually match employees name)

- *Full Company Name: The entire name of the company

- Company Phone/Email: Optionally, enter the contact information for the independent contractor (usually we track this information on the employee's record, so don't feel like you need to fill it out here)

- Contact Name: Optionally, enter the main contact's name

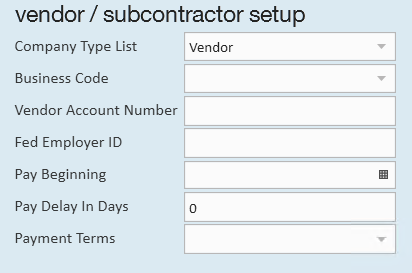

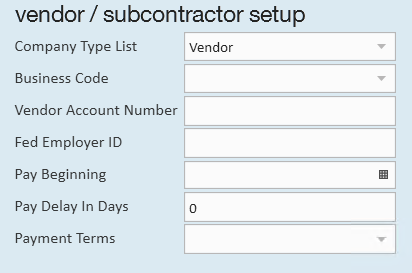

- Vendor/Subcontractor Setup

- Company Type List: Usually just leave this at Vendor

- Business Code: Optionally, select the type of business - This option can be used for reporting

- Vendor Account Number: Optionally, enter an account number for your records with the Vendor

- Fed Employer ID: Enter the FEID or SSN for the Independent Contractor

- Pay Beginning: Do not enter a date here for 1099 employees

- *Pay Delay in Days: Enter 0 for this to ensure your 1099 employees are paid on time

- Payment Terms: Optionally, select your payment terms if needed for record keeping purposes

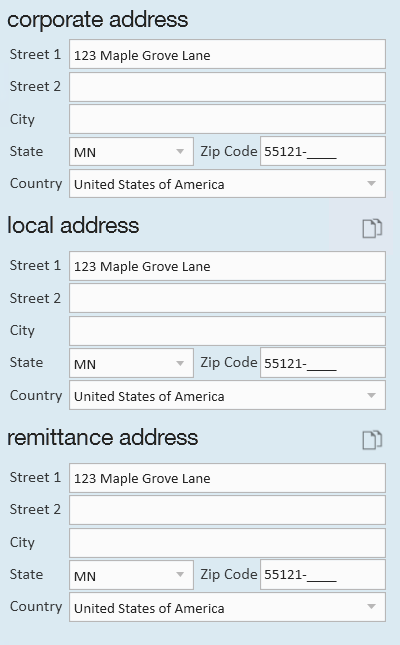

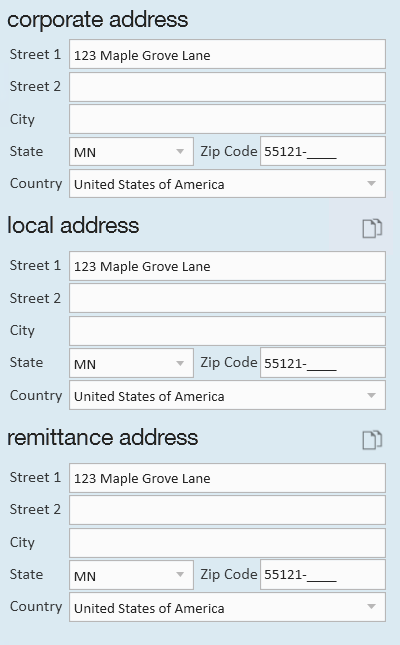

- Addresses: (The addresses here will be used to generate the 1099 for this employee)

- *Corporate Address: Main address for the Independent Contractor (typically all the addresses here will be the same for 1099 employees so use the copy button next to the local and remittance address to copy the corporate address)

- *Local Address: Enter a local address if applicable for the 1099 employee

- *Remittance Address: Enter an address for Remittance purposes

- Company and Contact information:

- Select Save

Review the 1099 Vendor Record Details

Now that the record is created, it's important to note the following items:

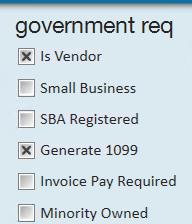

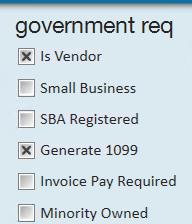

- Government Req: For 1099 employees the Is Vendor and the Generate 1099 boxes must both be checked. This will ensure a 1099 is generated at the end of the year for the employee.

- Do NOT create a Psuedo AIdent for this record. This will require the vendor payroll process to change and change this record from being a 1099 vendor to being a subcontractor vendor.

Linking a 1099 Employee to an Employee Record

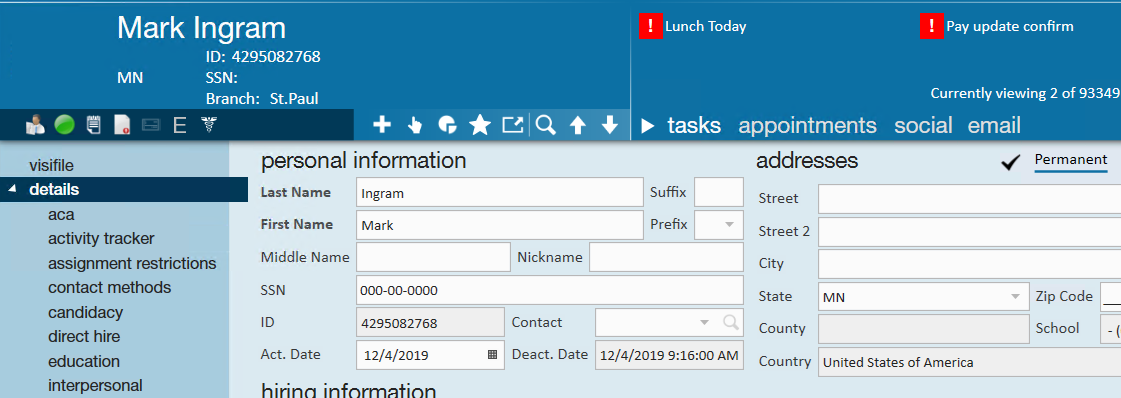

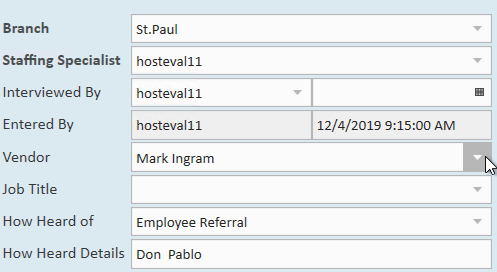

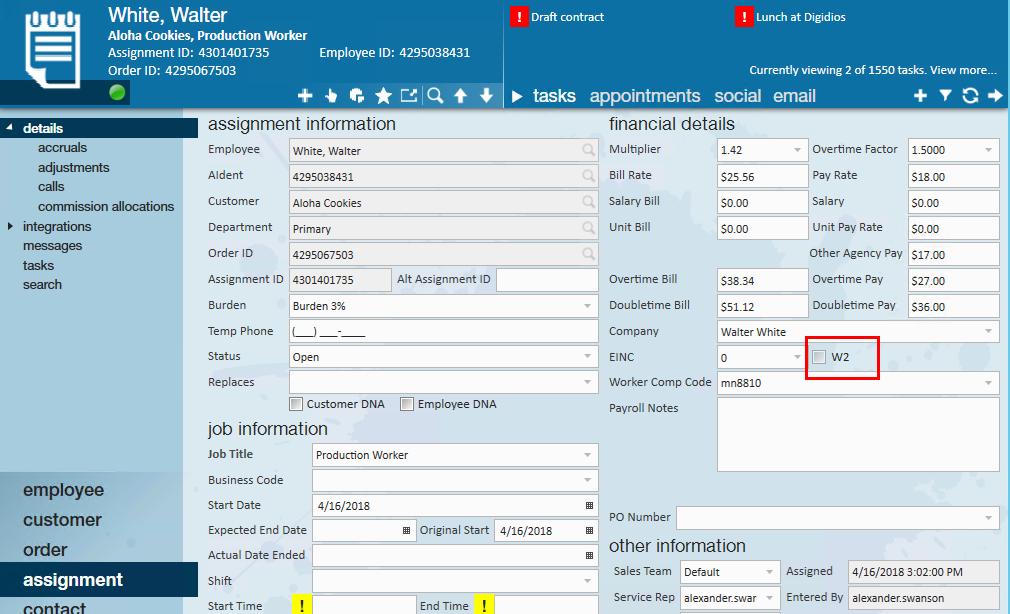

Now that a vendor exists, the system still needs an employee record for the independent contractor. This record will be assigned to orders just like a W-2 employee but has visible markers on its employee record as well as its assignments that will help identify its status. Additionally, transactions for this record will experience payroll differently and will be processed through a 'SubPay' Payroll run.

To begin, create an employee record in the same way that you would for a W-2 employee. Because the client is not responsible for taxes, the SSN and address are not important.

Under the 'details' page on the new employee, on the right-hand side, is a field for 'Vendor'. This field will link this employee to the employee record from before. Select the vendor that corresponds to this employee. This is the step that transforms this record from a taxable W2 Employee to a non-taxable 1099 employee.

On the Avatar will appear an icon labelled "Subcontractor."

*Note* If you create an assignment for the 1099 employee without filling in the Vendor field on the employee record, you will create an assignment whose timecard will be for a W-2 employee, and you cannot change it back. You will have to close the assignment, link the vendor and then create a new one from a record with the correct information.

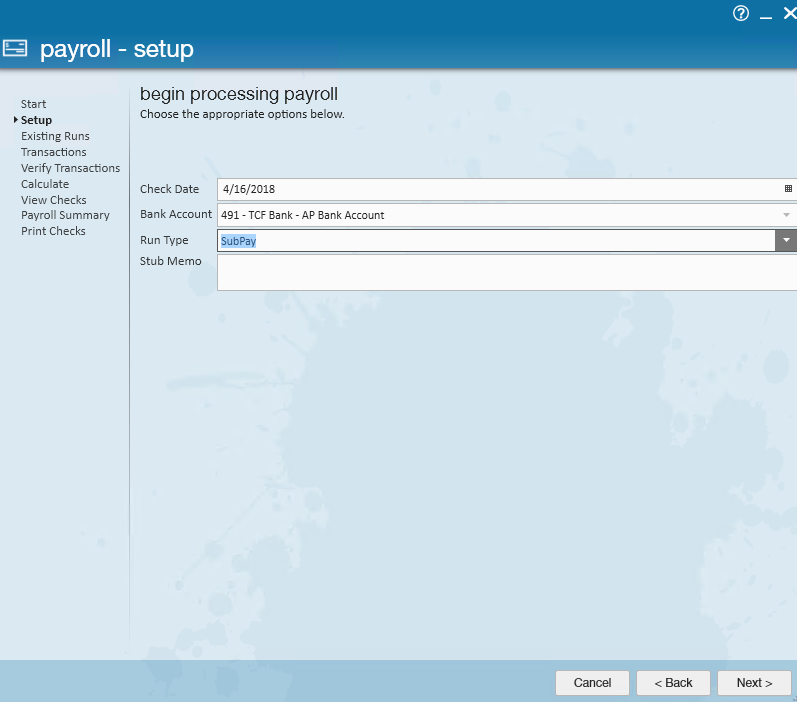

Processing 1099 Payroll Overview

For a 1099 employee, process them through a 'SubPay' payroll run type. This payroll run functions similarly to a normal 'checkrun' payroll run with the exception that it will only pull employees that have non W2- transactions.

For more information, check out Vendors - Paying 1099 Employees