Invoice Editing Options

In Enterprise, there are many different ways to edit invoices. In this article we are going to cover how to update or recalculate sales taxes and surcharges on an invoice.

Other Edit Options Include:

- Enterprise - How to Edit Invoices: Includes manual edits, creating credit/debit memos

- Enterprise - How to Recast an Invoice: To update non-financial information including PO numbers, addresses, etc.

- Enterprise - How to Merge Invoices

Recalculating Taxes & Surcharges

If you look at an invoice to find that sales tax has been applied but shouldn't have or you're missing an ACA surcharge, don't panic! This recalculating option will help you update sales tax information or ACA surcharges on an invoice without creating a Credit or Debit Memo (-1) or requiring a manual edit.

Before you Recalculate

Before you recalculate taxes & surcharges, you will want to fix root cause of this issue. Navigate to the Customer's record, and find the sales tax or ACA surcharge that is incorrect.

For Sales Tax:

Maybe you are missing sales tax on a worksite or maybe it was added accidentally.

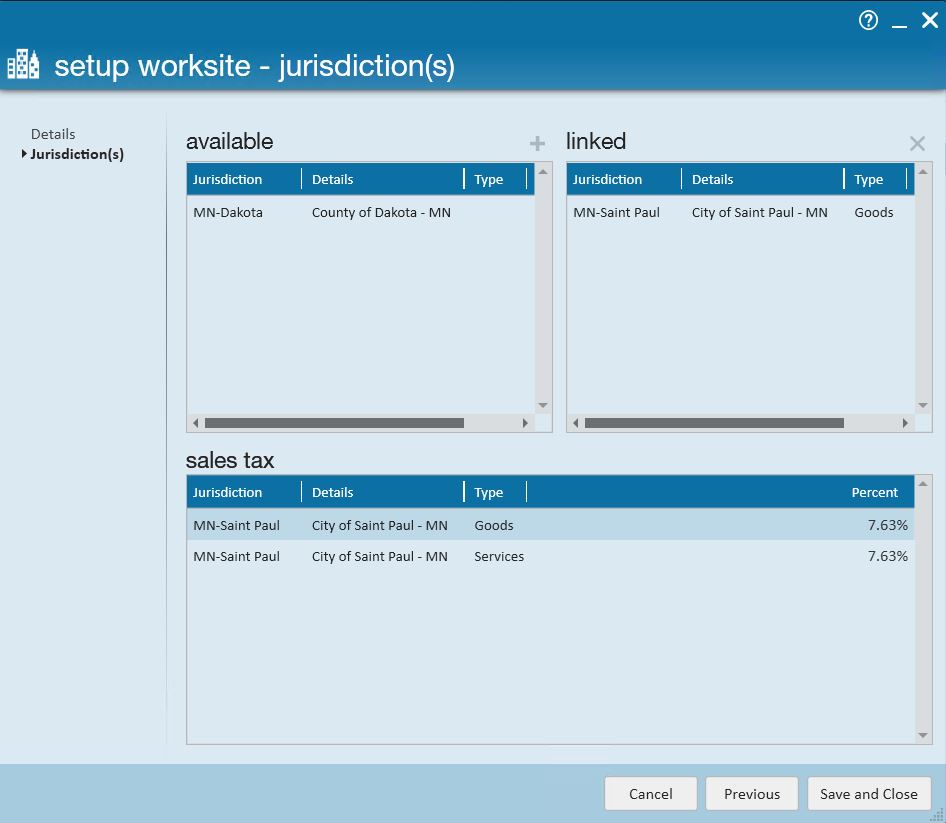

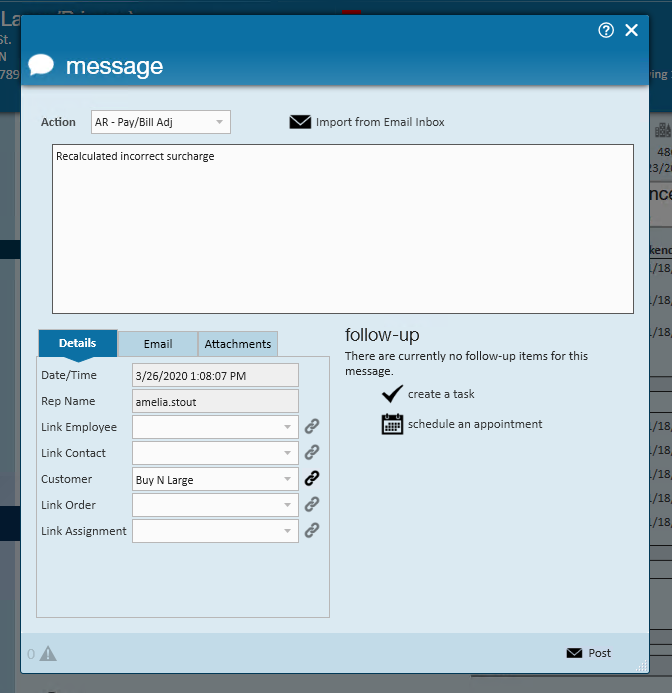

- On the Customer record, select details > worksites

- Click on the worksite you want to review

- Click the pencil icon to edit the worksite

- Click save and continue

- Remove or add Sales tax before saving

*Note* Sales tax can also be added to the customer or department record. Check out How to Set Up Sales Tax on a Customer for more information.

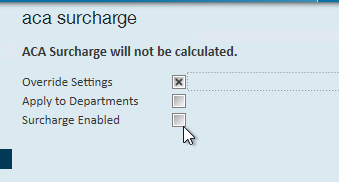

For ACA Surcharges:

Maybe the ACA surcharge for this customer has changed or it wasn't added at all. In either case, you can edit the ACA surcharge on the customer record as long as the ACA surcharge option is enabled in your system.

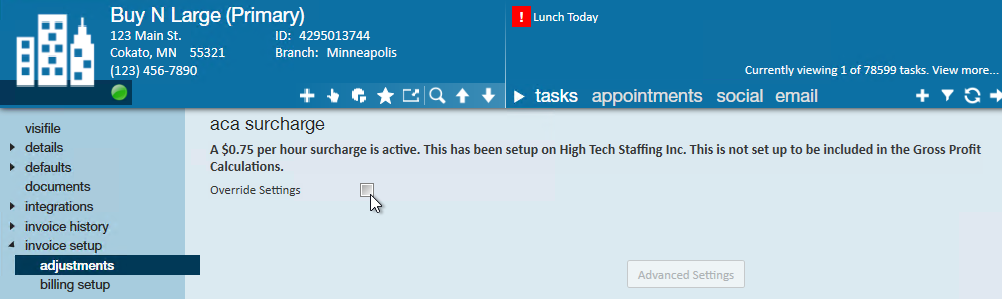

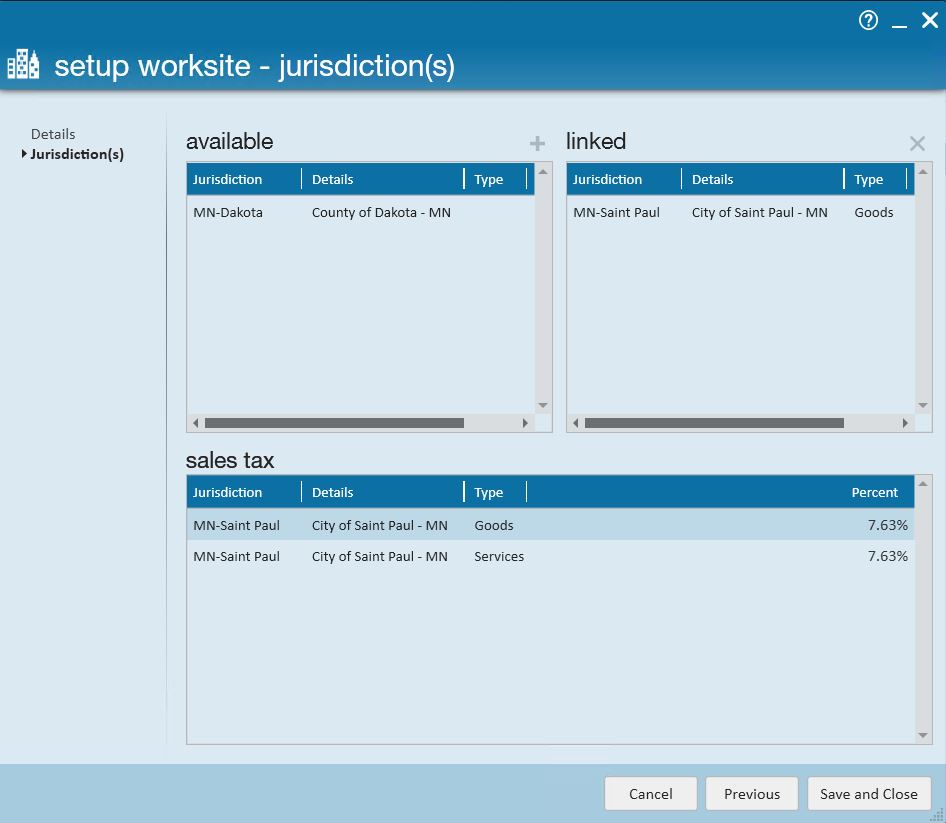

- Navigate to the customer or department record that has the wrong ACA surcharge

- Select Invoice setup > Adjustments on the left

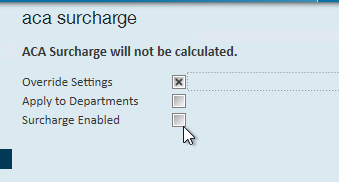

- Check the box to override the existing ACA Surcharge

- Make any additional changes to rate or calculations

*Note* If you don't see these options, ACA surcharges may not be enabled in your system. For more information, check out Affordable Care Act Surcharges.

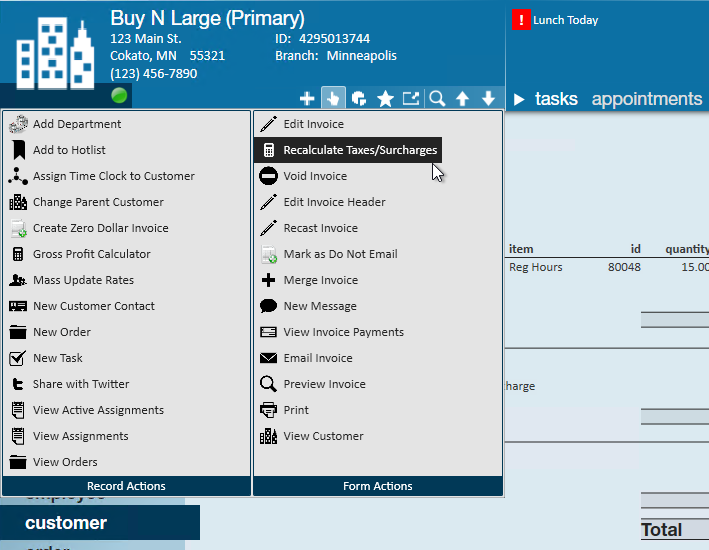

To Recalculate Taxes and/or Surcharges on an Invoice

This step can only be done once the corrections have been made to the customer record.

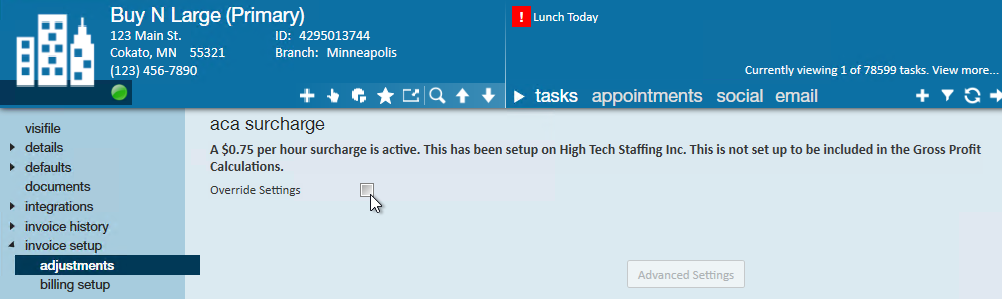

- Navigate to the invoice you want to recalculate (check out Enterprise - How to Find Processed Invoices)

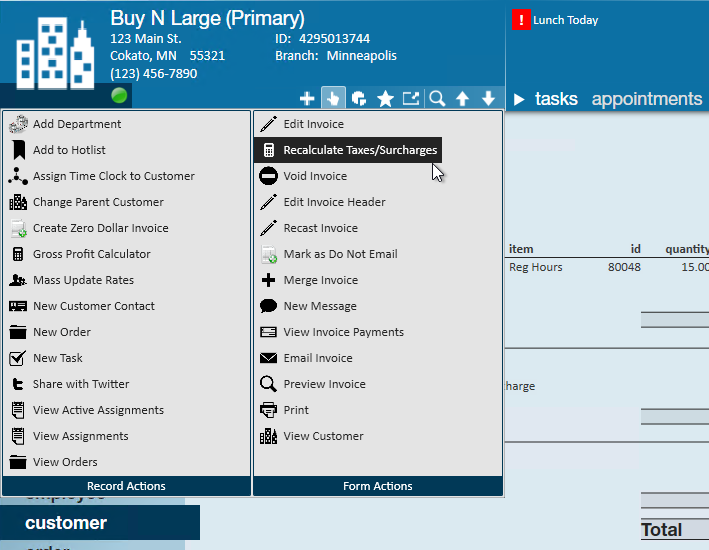

- Navigate to the Actions Menu

- Choose Recalculate Taxes & Surcharges

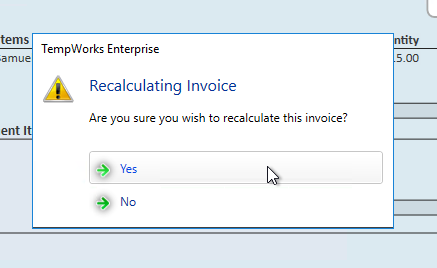

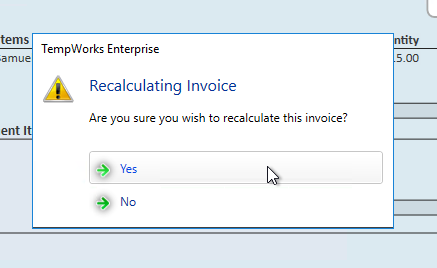

- Say Yes when you are prompted to confirm :

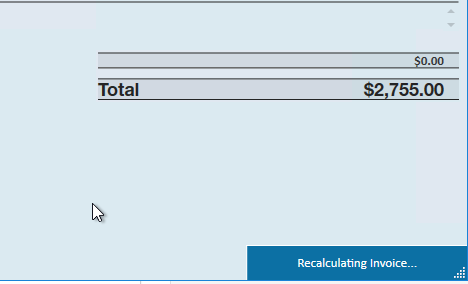

- A Recalculating message will appear in the lower right:

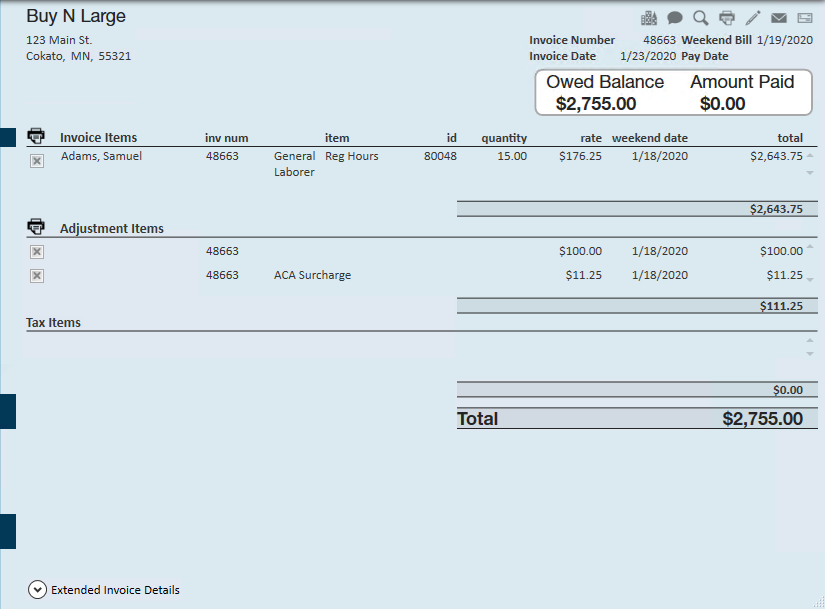

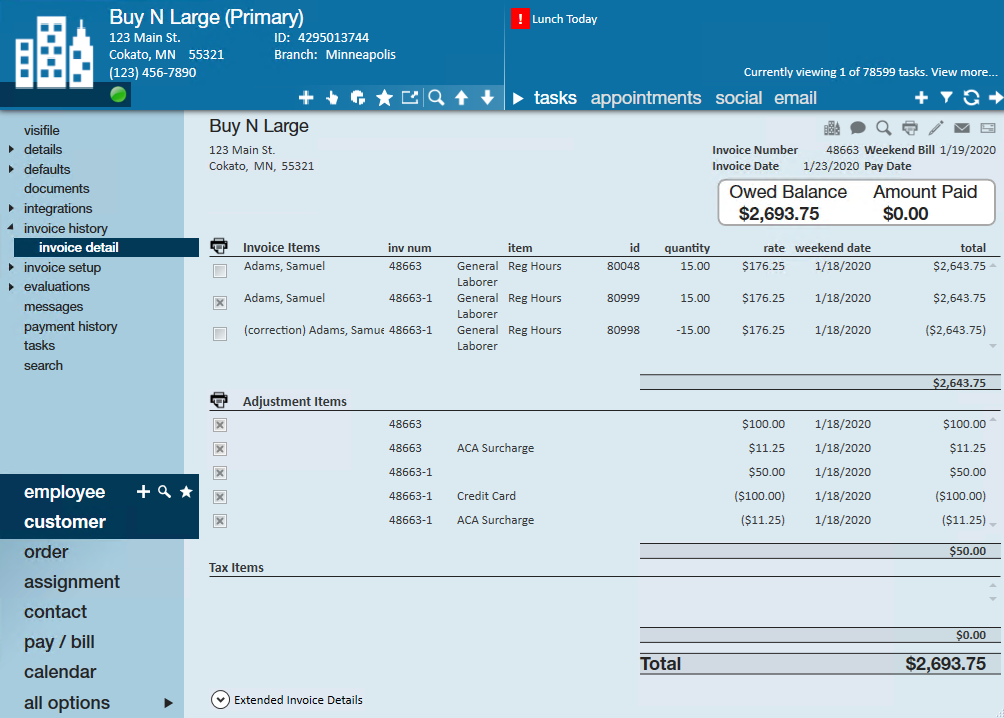

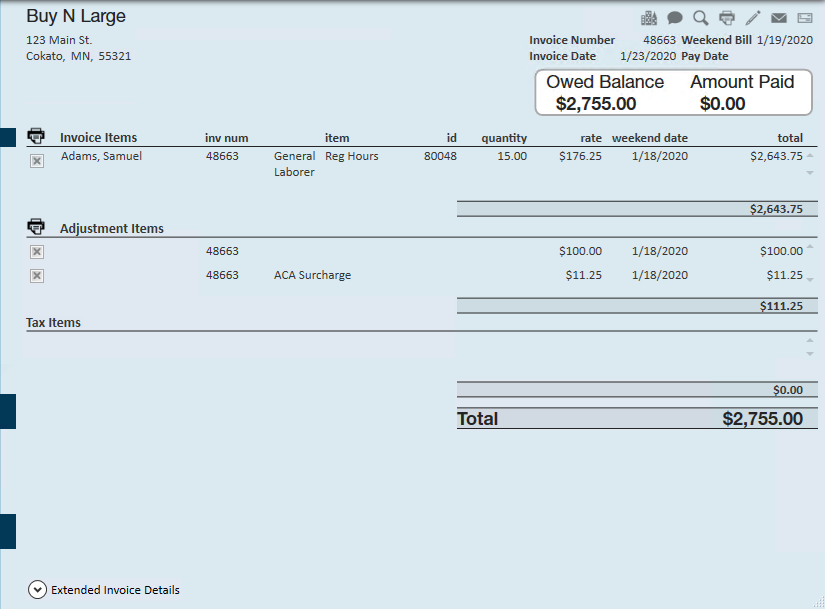

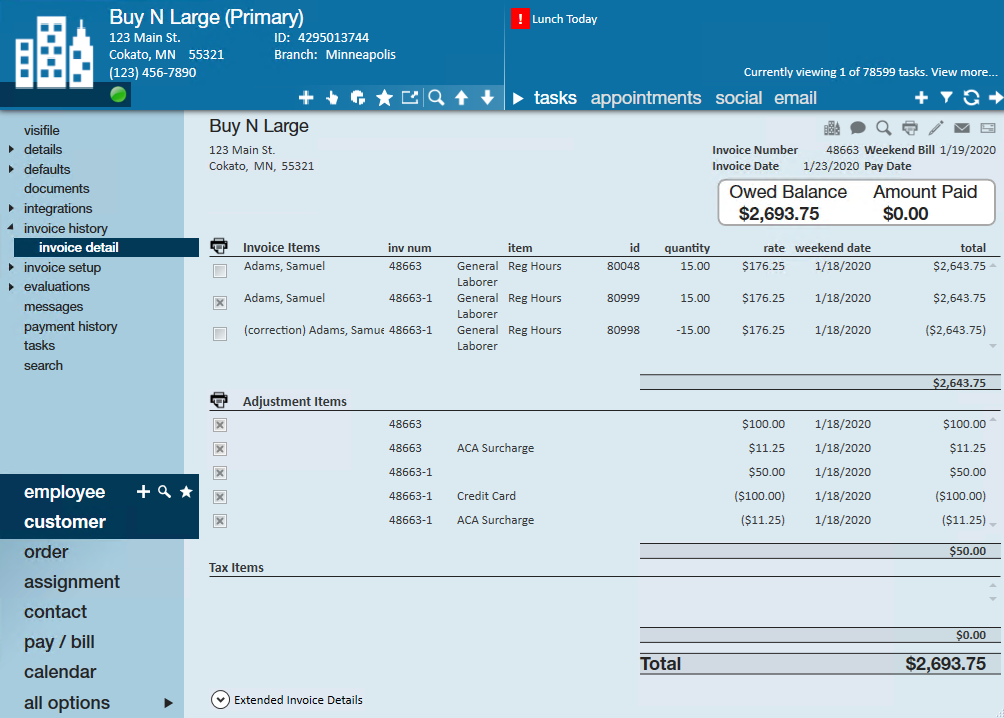

- When you look at your invoice again, you will see the corrections made to remove the previous charge/transaction and create the new line item in it's place:

When you preview the invoice you will see the correct amounts.

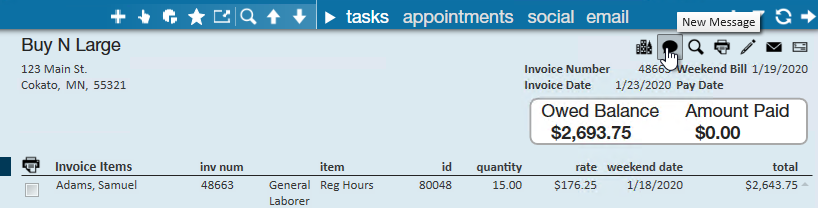

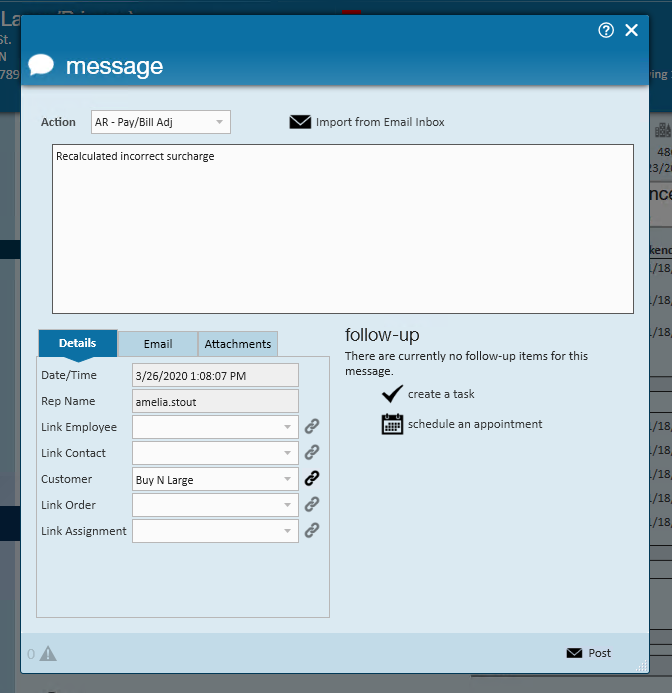

We recommend also logging a message on the invoice to note why this change was made for your records:

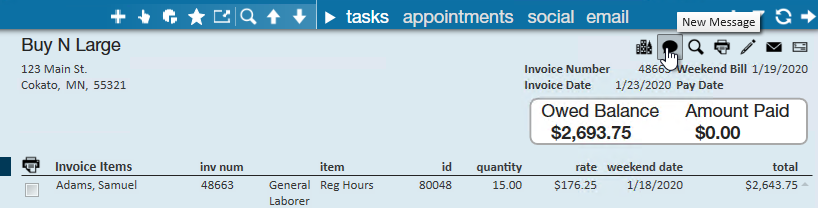

- Select the Message icon in the upper right

- Select a message action code and enter a message before clicking post

Messages can be found on the customer record or under the extended invoice details at the bottom of the invoice: