What Is WOTC?

WOTC or Work Opportunity Tax Credits give staffing companies credits for hiring employees with certain backgrounds, etc. The IRS says:

The Work Opportunity Tax Credit (WOTC) is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment.

WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers.

According to the IRS (https://www.irs.gov/businesses/small-businesses-self-employed/work-opportunity-tax-credit)

Tracking WOTC Eligibility

If an employee has been found to be WOTC eligible, you can find this information under the details section of the employee record

There are two ways the WOTC eligibilty status can be populated:

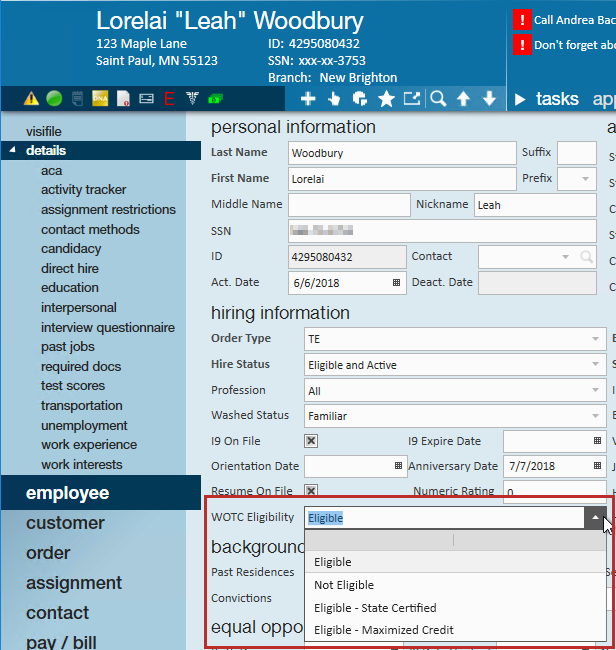

- Manually enter the WOTC status within the drop-down.

- This option is utilized if you are not utilizing any of our HRCenter WOTC Integrations or have chosen not to have the results postfill to the employee record.

- Using a WOTC Integration

- If the employee completes the WOTC questionnaire via the HRCenter integration, your system can be configured to show the WOTC eligibility results on the employee record. A message will also be logged on the employee's file when the WOTC eligibility is determined.

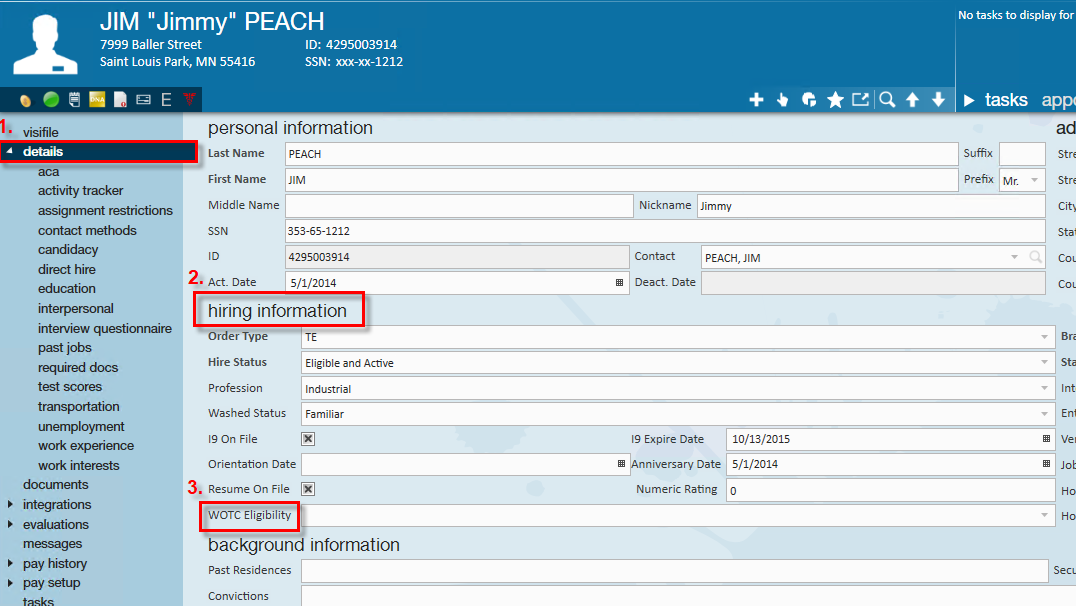

Once you have verified the employee's eligibility navigate to details (1.) , hiring information (2.), WOTC Eligibility drop-down (3.) to distinguish their WOTC status:

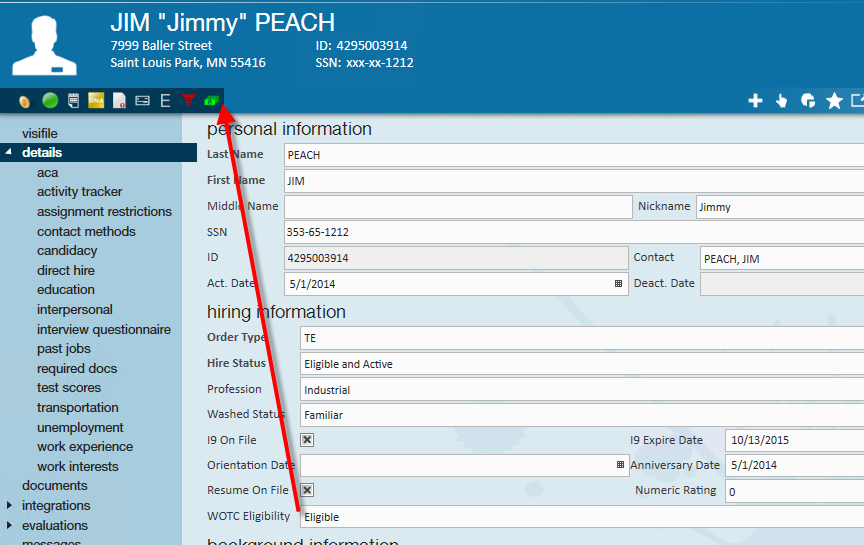

If the status is set to "Eligible" a WOTC icon will populate within the avatar section of the employee file as shown:

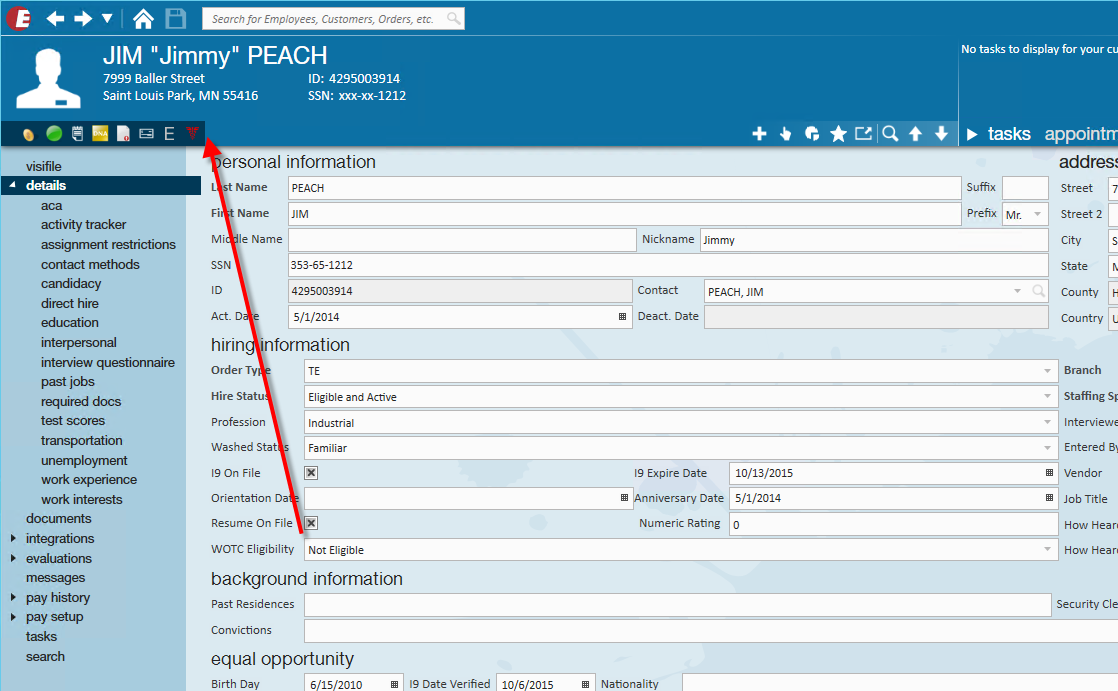

If the status is set to "Not Eligible" no icon will appear within the avatar section of the employee file: