Users may utilize Enterprise to bill back employee benefit costs, payroll and worker compensation costs, recruiting costs, etc. through the PEO module for specific customers.

*Note* Users will need to be setup with the correct security role labeled "PEO setup" for the PEO section to be visible within a customer record. Please contact Tempworks support if you need assistance.

PEO Setup

Within Enterprise, users may automatically bill back the costs by customer or department, whether they are flat fees or percentages.

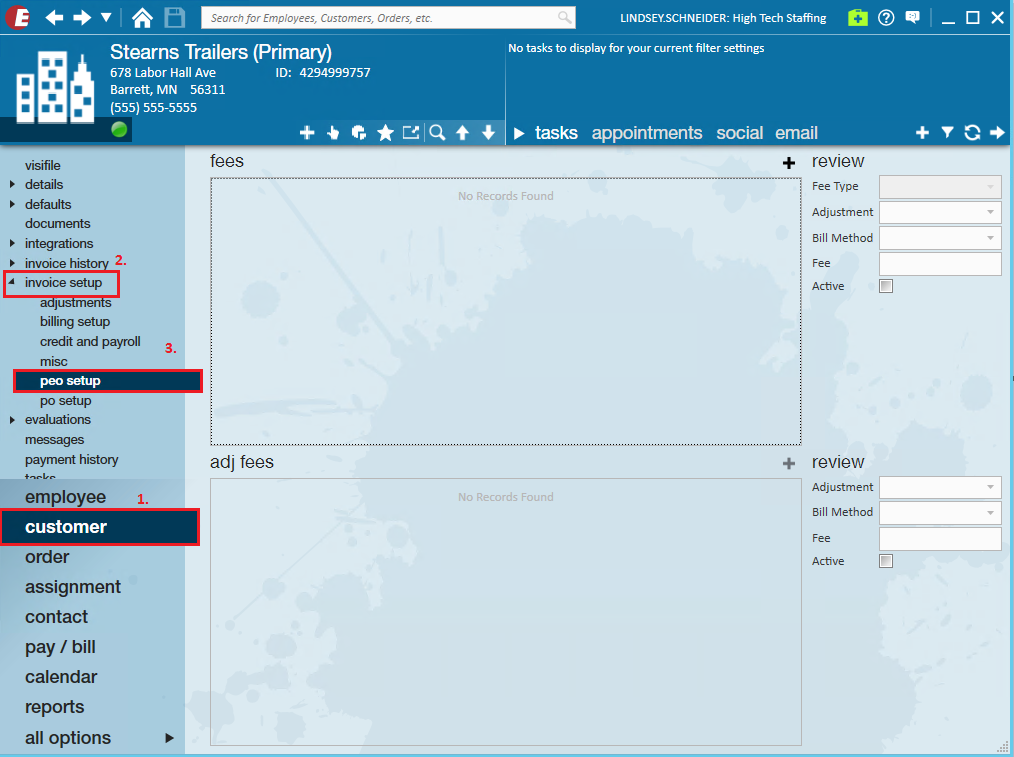

Navigate to the customer or department of choice, select invoice setup, PEO:

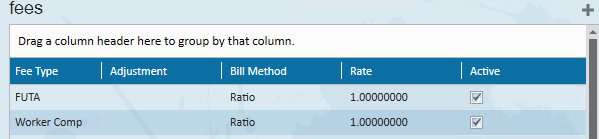

The PEO section is broken out into two sections, fees and adjustment fees.Fees

Fees are the employer costs that users wish to include to bill back. The rate will be separated by WC code, Tax and Admin fees per customer specifications.

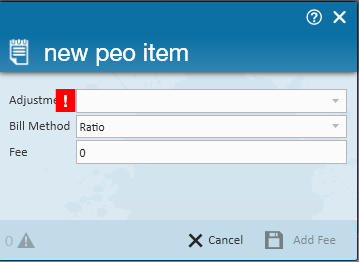

To add a new fee select the + icon, this will open the new peo item setup screen:

From the Fee Type drop down select the adjustment you wish to add to the customer record.

*Note* The adjustments within the fee type drop down will need to be setup by TempWorks to ensure they are flagged as PEO adjustments. Please work with TempWorks support to review these specific adjustment types.

Once the fee type is selected, users may also enter bill method information and select whether they wish to bill a flat fee or ratio (percentage).

In the following example the adjustment type of per check fee has been setup to charge .50 per check.

*Note* The fee type of per check fee will only allow a flat fee to be selected for the bill method.

*Note* When entering a ratio: it should be entered as a percentage of the amount of the expense. In the example below, Worker Comp is setup at 1.0, which will calculate to 100%. If you wish for a fee type to calculate at 50%, enter .50 in order for the system to calculate the ratio correctly.

In the example, for FUTA, if $50.00 was paid out and you want to bill back all of that $50.00, you enter 1.0 into the "Fee" field after selecting the bill method of Ratio to obtain 100% of what was paid out.

PEO fees can be edited by highlighting the specific fee and utilizing the review section to edit, update, or deactivate/reactivate fees.

Adj Fees

Adjustment fees can be identified as the employee adjustments to be included as part of the bill back costs to customers. Navigate to the adj fees section and select the + icon. This will open the new peo item window:

Select from the adjustment type drop down to choose the adjustment of choice, verify the bill method, and enter the fee. The logic for data entry is the same as the fees section.

In the following example, the parking reimbursement adjustments will be billed back at a ratio of 100% from the employees tied to this customer.

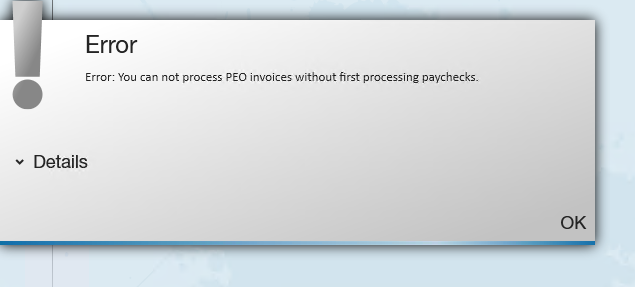

Once the PEO section is completed within the customer section, users must process payroll before PEO's can be calculated, which occurs during the invoice process.

*Note* If an attempt to run Invoices occurs prior to running payroll, users will receive the following error:

In the following example, once payroll has been calculated and invoices processed, users may view the PEO costs associated with the invoice: