What are Fringe Benefits?

Fringe benefits refer to options like company car, subsidized meals, etc. that supplement an employee's salary. These amounts are typically taxable and need to be reported on employee W-2s. For more information on fringe benefits check out the IRS's Employer's Tax Guide to Fringe Benefits.

*Note* As always, if you are unsure about how a benefit or amount should be taxed, please contact a tax professional.

Accounting for Fringe Benefits in Time Entry

We will be documenting the personal use of a company car in the following example.

In general, the fair market value of an employer-provided vehicle is the amount the employee would have to pay a third party to lease the same or similar vehicle on the same or comparable terms in the geographic area where the employee uses the vehicle. A comparable lease term would be the amount of time the vehicle is available for the employee's use, such as a 1-year period. The use of a company-provider car is therefore considered taxable income from the IRS's perspective. As such, we need to include it on employee W-2 at the end of the year.

*Note* Before you start this process - check your employee record for reoccurring adjustments. Fringe Benefit transactions should not include any regular adjustments.

You can either temporarily deactivate the adjustment on the employee's record or override the reoccurring adjustment on the timecard. Check out Enterprise - One-Time Adjustments and Overrides for more information.

Step 1: Enter the Fringe Benefit

- Navigate to Time Entry

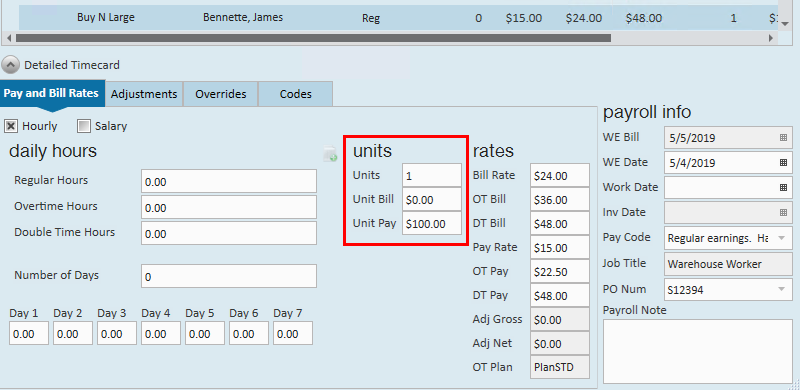

- Select the timecard for the employee & double click to open the detailed timecard

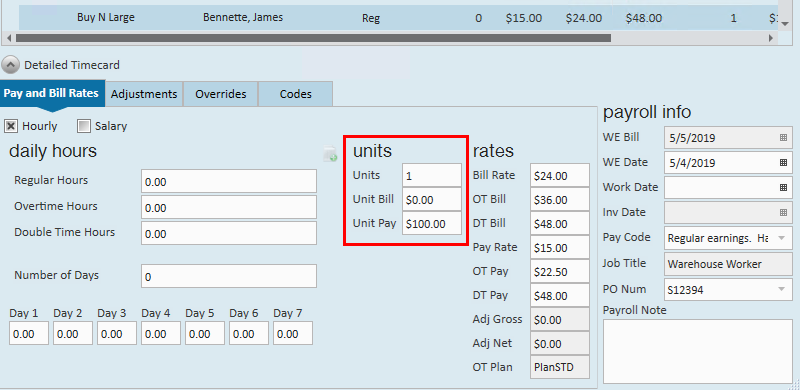

- Under Units, enter the following:

- 1 Unit

- Total amount for the fringe benefit under 'Unit Pay'

- If billable back to the client, enter an amount within the 'Unit Bill' field. Otherwise, leave at 0

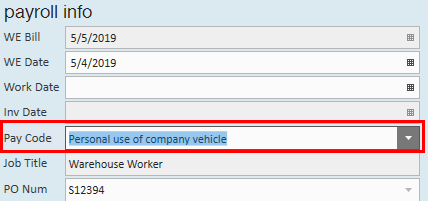

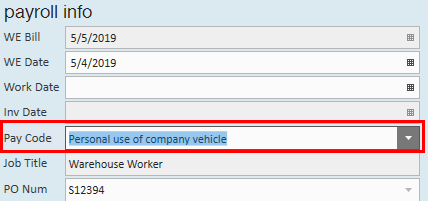

- Change the 'Pay Code' on the time card to the related benefit. Example: PUCC (personal use of a company car)

*Note* If you do not have a Pay Code for the fringe benefit you are trying to document, your admin may be able to set up the Pay Code. Contact support for any questions or concerns.

Step 2: Deduct the Adjustment Amount

Now that we have added the amount for W-2 purposes, we need to deduct the same amount to ensure the employee does not pay for it.

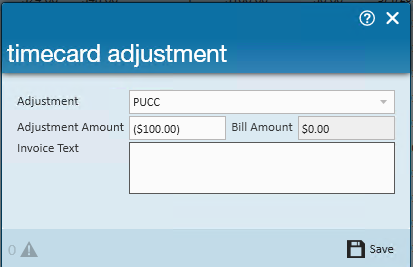

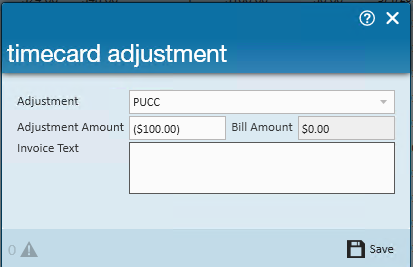

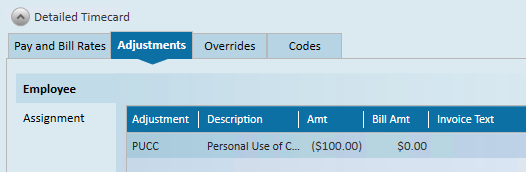

- Navigate to the 'Adjustments' tab of the detailed timecard

- Select the '+' to add a new adjustment

- Select the adjustment type related to your benefit. Example: PUCC

- If you do not have an adjustment type related to your benefit, your system or back office admin will be able to add one for you. See How to Set Up Adjustments in Administration for more information.

- Within the 'Adjustment Amount' field, enter the total amount for the benefit as a negative number

- This will ensure the amount is negated

- Select 'Save'

Step 3: Enter Time or Adjust Taxes

Is there any weekly pay for this employee?

If yes, then enter hours on a separate timecard and skip to the next step.

If no, then follow the steps below.

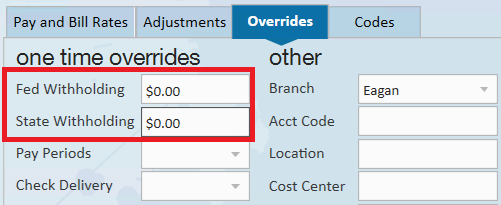

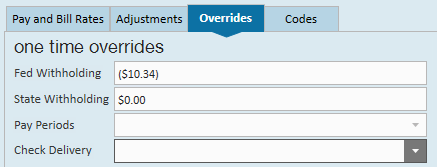

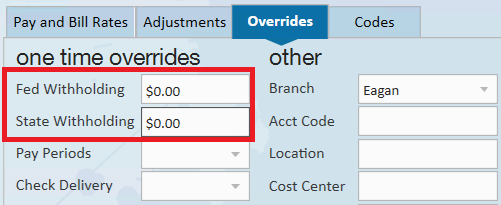

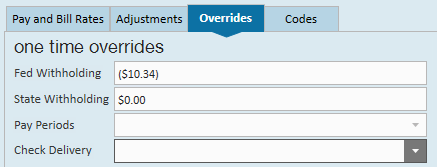

- Update "Fed Withholding" and "State Withholding"

- Navigate to the detailed timecard

- Select the "Overrides' tab

- Enter $0 for "Fed Withholding" and "State Withholding"

- Select "Save"

- *Note* Due to the calculation process outlined below, you will need to manually update the "Federal Withholding" amount to $0.00. This amount will be updated as stated later within this article.

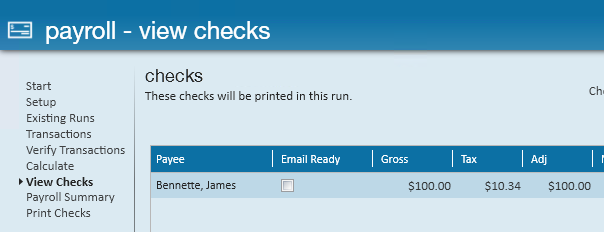

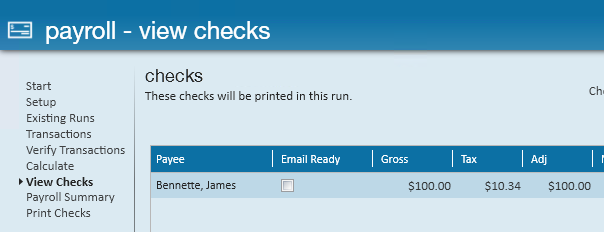

- Calculate the amount of taxes that are being withheld from the check

- You can do this by starting a payroll run and getting the amount from the 'View Checks' screen

- Remember to abandon the payroll run if you used this method

- Override the Federal Amount

- Return to the detailed timecard > 'Overrides' tab

- Enter the federal tax amount you found above as a negative number under 'Fed Withholding'

- Select 'Save'

This will result in a net of $0. If you want them to still pay for the withheld taxes on their next paycheck, you will need to create a garnishment adjustment on their employee record.

Step 4: Run Payroll

Proof and run payroll as normal.