What are Worker Comp Codes?

Worker compensation codes are codes that insurance companies utilize to identify specific categories of work. These codes are important to setup on Customer and Order records to ensure the right worker comp codes are being tied to the correct job titles you are staffing.

Worker Comp on Order Record

Worker Comp on Order Record

Worker Comp Under Customer DefaultsWorker comp codes are divided by state since rates usually differ from state to state, so if you are staffing in multiple states you will need separate codes for each state (ex. 8810 for MN and 8810 for WI).

Worker Comp Under Customer DefaultsWorker comp codes are divided by state since rates usually differ from state to state, so if you are staffing in multiple states you will need separate codes for each state (ex. 8810 for MN and 8810 for WI).

How to Add a New Worker Comp Code

Doing business in a new state? Staffing a brand-new position? You may need to set up new worker comp codes.

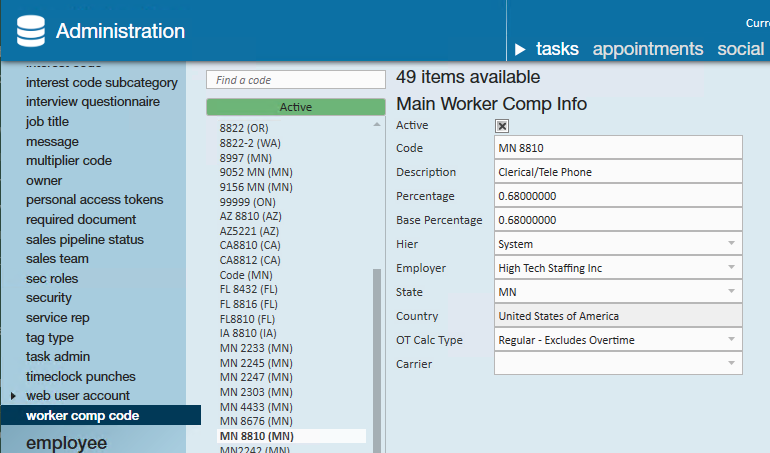

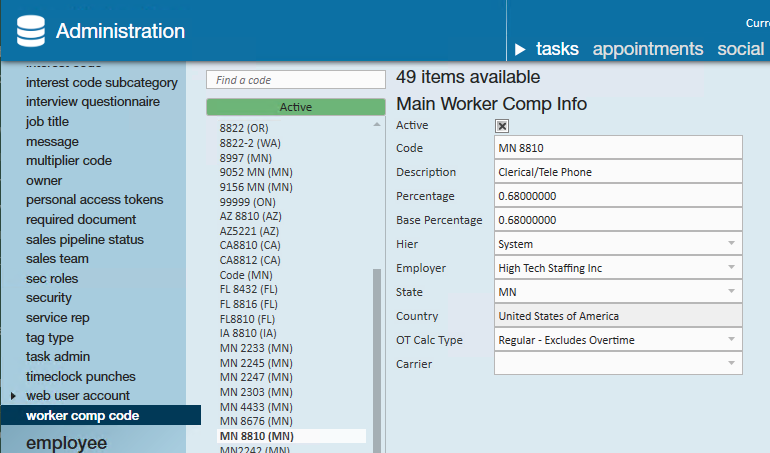

- Navigate to all options > administration and select 'worker comp code' on the left:

- Select the "+" icon.

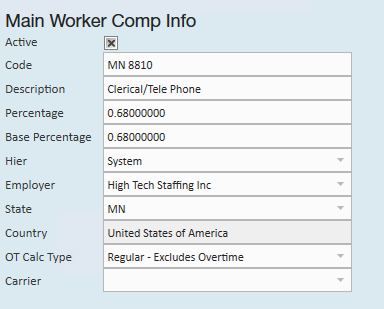

- Enter the following information:

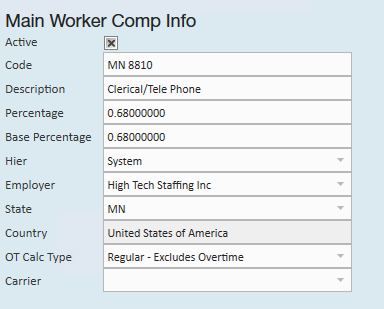

- Code - How it will be displayed in in the system (ex. 8810 or MN 8810).

- Description - What category of work should this code be associated with.

- Percentage - Used for calculations.

- Base Percentage - Often matches percentage field.

- Can be used for differentiating a buy down on a percentage or to track and report a "total" percentage vs. an "actual cost" percentage.

- Hier - To what level of hierarchy does this code apply? Is this code one that is specific to one branch or is it used system wide?

- Employer - Select your company.

- State - Select which state this worker comp code is for.

*Note* Please keep in mind the following for Worker Comp Codes that are within Oregon and Washington:

- Oregon

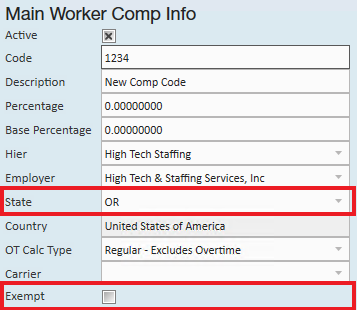

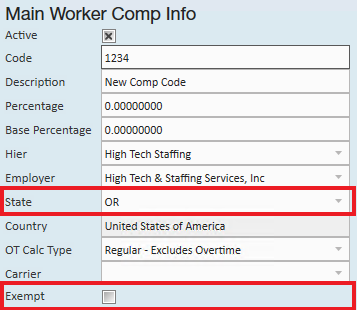

- For Oregon Worker Comp Codes, you will have an additional option as a checkbox for "Exempt". By default, this box is unchecked, meaning the Oregon Worker Comp Code is not exempt from Worker Comp Tax:

- For Oregon Worker Comp Codes, you will have an additional option as a checkbox for "Exempt". By default, this box is unchecked, meaning the Oregon Worker Comp Code is not exempt from Worker Comp Tax:

- Washington

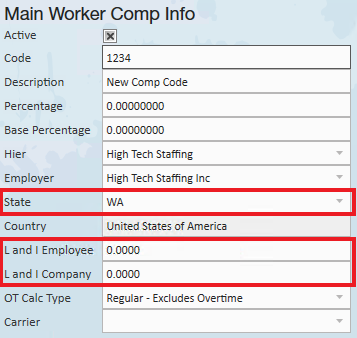

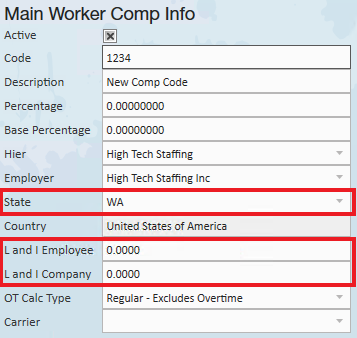

- For Washington Worker Comp Codes, you will have additional options for "L and I Employee" and "L and I Company" rates. These are required when creating/editing Worker Comp Codes that are located within the state of Washington:

- For Washington Worker Comp Codes, you will have additional options for "L and I Employee" and "L and I Company" rates. These are required when creating/editing Worker Comp Codes that are located within the state of Washington:

*Note* When a worker comp code is no longer going to be used in your system, you can deactivate it by unchecking the "Active" check box. This will stop it from showing up as an option on any future order.

Auditing Your Records

The correct worker comp codes need to be selected correctly by your front and/or back office staff at the customer, order, or assignment level.

Use the Defaults:

We recommend setting default worker comp codes on each customer record based on your contract(s) with them. This can help limit the number of choices your recruiters or sales staff have when creating orders and assigning people. Check out Enterprise - How to Set up Customer Defaults for more information.

Run Reporting:

- Worker Comp Breakout

- Run this report to review hours paid under each worker comp code

- Worker Comp List

- Run this report when you update percentages each year to review the current codes in your system, short description, and current percentages

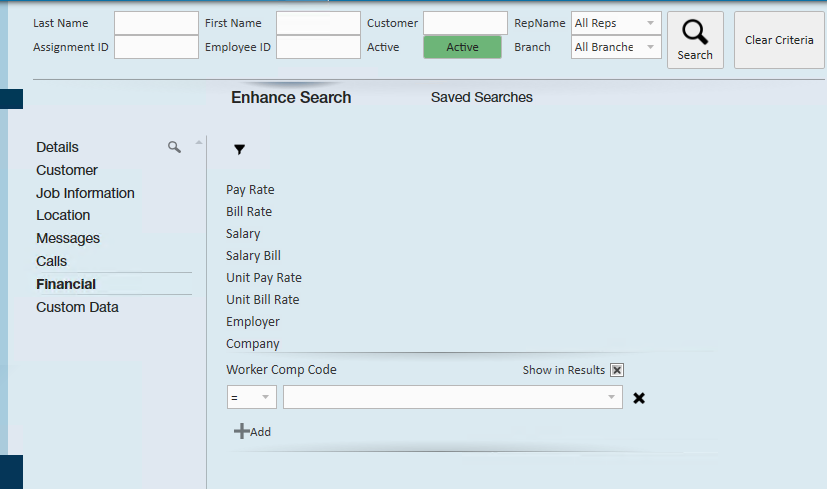

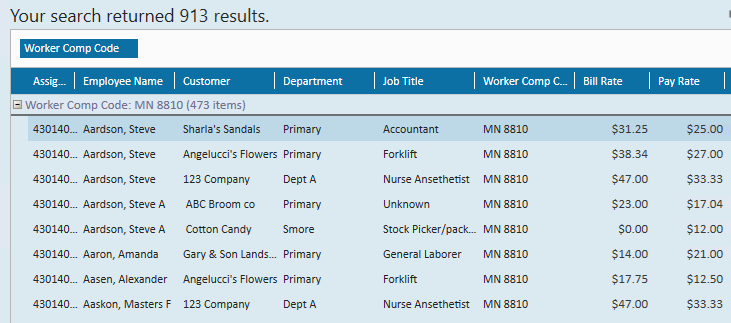

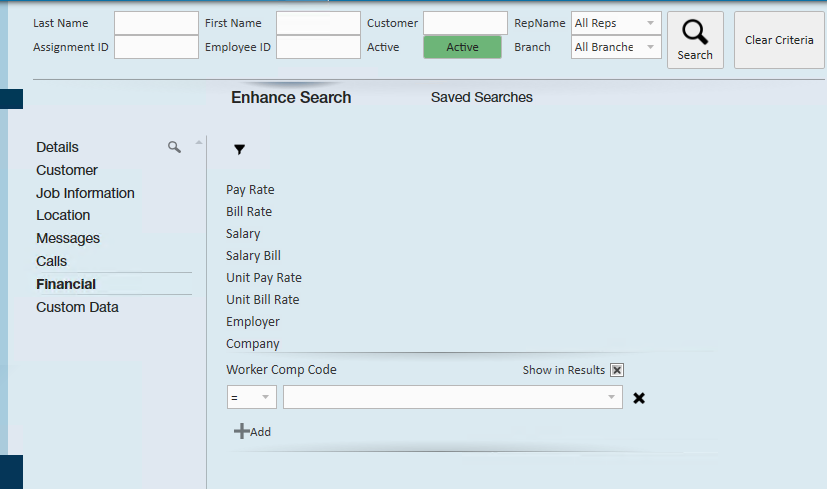

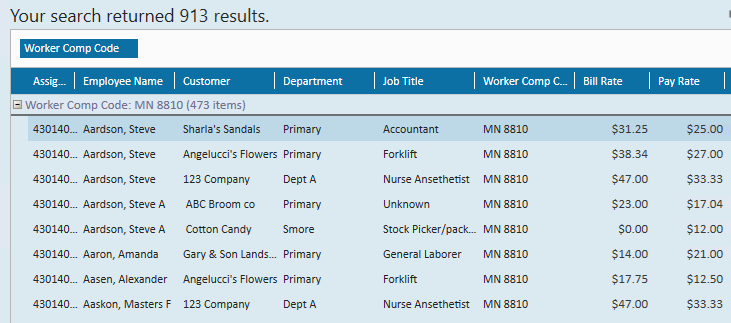

- Assignment Search

- One the best ways to triple check your system is to pull a list of active assignments and include worker comp code

- You will be able to group by worker comp to quickly glance through comparing job title & worker comp code

- You will also be able to export your results to excel

- One the best ways to triple check your system is to pull a list of active assignments and include worker comp code