Welcome! Hope June has been treating you well. 🌻

*Note* For all self-hosted clients, as always, ensure you install all updates to give your users the best experience and new features.

The Highlights

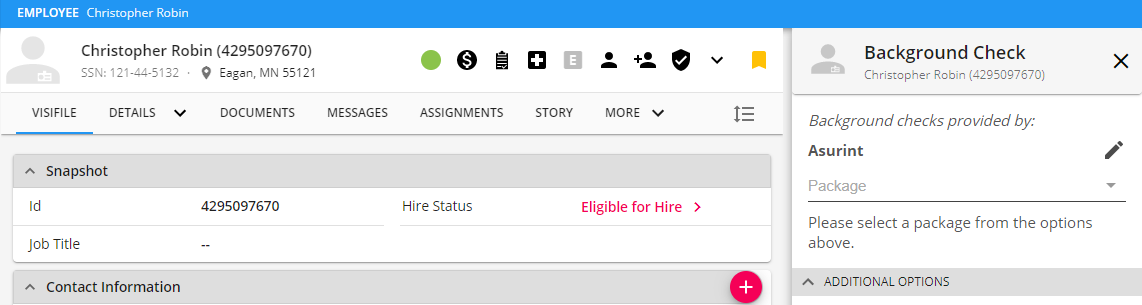

Asurint Background Checks in BeyondAsurint, another one of our background check provider partners, is now integrated in Beyond allowing your users to quickly submit background check requests and check statuses without leaving Beyond! Check out all of our current providers and learn more about how the integration is setup: Beyond - Background Check Providers and Setup.

To learn more about how background checks work in Beyond, check out Beyond - How to Run a Background Check. Talk to your TempWorks Account Manager to get started with Asurint today! | |

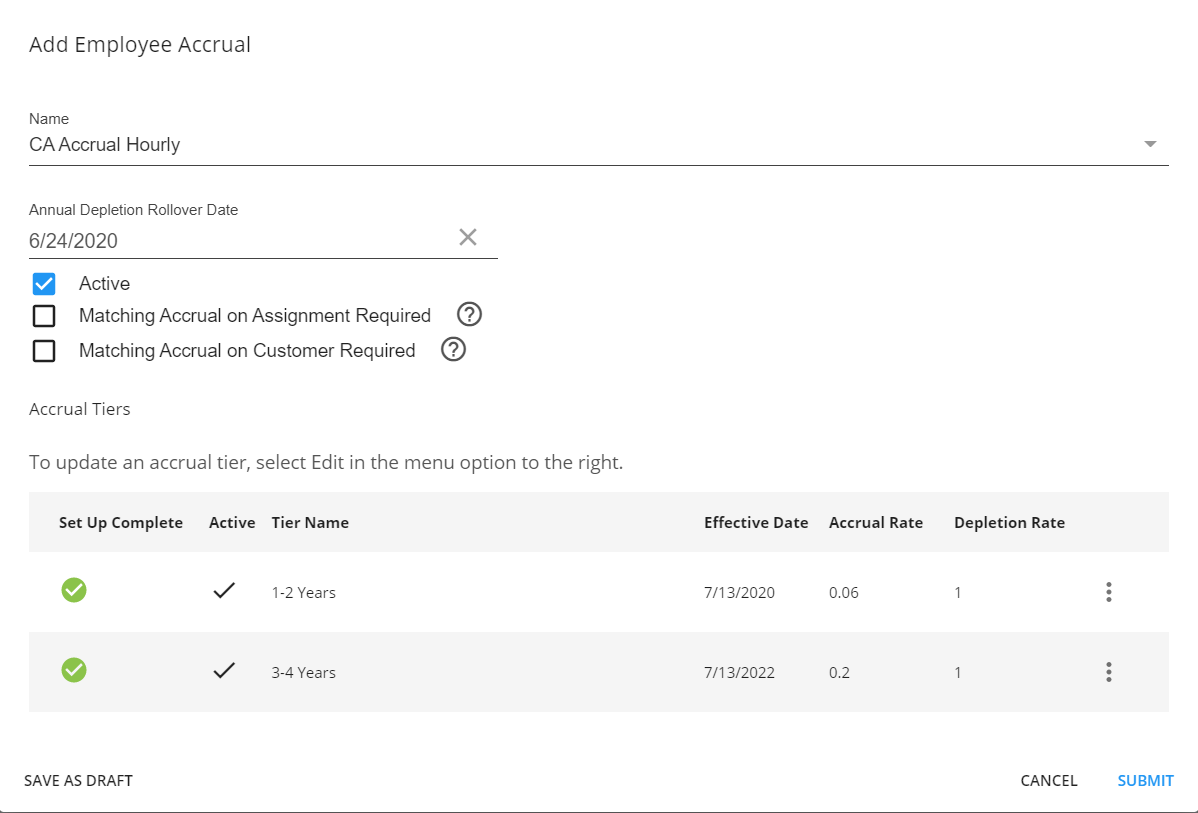

Employee Accruals in BeyondAccruals can be sick time, PTO, vacation, or other accrued hour packages for your employees. As our first phase of accrual development in Beyond, we've added the ability to add or manage accrual packages and history on the Employee's record. To learn more, check out Beyond - Managing Employee Accruals |

Additional Updates

COVID Report Updates:

- COVID Provisions Report:

- Added an Errors column that will display number of COVID related payroll errors for that employee

- Add a group by option titled "Error Count" that will group each report row by number of COVID related payroll errors that have been received

- Added option to expand each line item to show error messages

- Added a New Report called the "CARES Act PPP FTE Average"

- This is the same as the FTE Average section of the CARES Act PPP Loan Forgiveness Estimator

- CARES Act PPP Loan Application & Loan Forgiveness Estimator Reports:

- Made performance enhancements to make these reports run faster

- Updated default cap amount to $46,154 (100,000/52*24)

- Changed the 2020 Q1 modified wages to do /13*# of weeks and respect the same period cap to allow for varying periods

- Added a warning to the Loan report if you are not running for a full week (since we are comparing figures, Running for 13 days rather than 7 will get you different results but same amount of week difference for Q1 Modified wages)

- Additional updates to CARES Act PPP Loan Forgiveness Estimator:

- Added parameter for Period Length (defaults to 24 weeks but can be changed)

- Updated form to calculate 60% on Line 10 of Loan Forgiveness Calculator form (Was original 75%)

- Added Q1 original and modified wages to Table 2 (100k+, no financial reporting) to allow you to tie back table 1 and table 2 to the full PPP Payroll cost tab

In Beyond

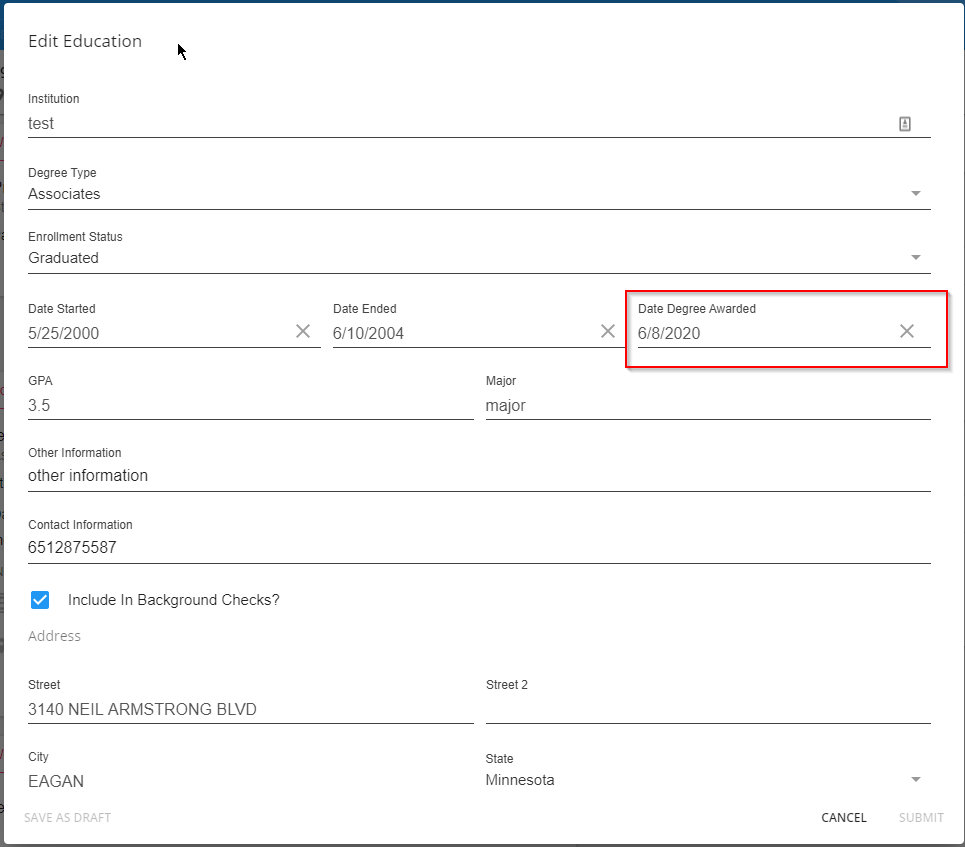

- Date Degree Awarded field has been added to education card. To learn more about education, check out Beyond - How to Create an Employee Record Story

- Sales team drop down will now only show active sales teams (customer record > details > sales and service)

Tax Updates:

- New Mexico added head of household juris and updated tiers for married/single.

- Kentucky increased Occupational License Fee from 1% to 1.25% for Ohio County effective 7/1/2020

- Ohio tax updates include:

- Increased wage base from $100,000.00 to $111,075.00 for Christ-Childrens Med Ctr JEDD, Hamilton Coun

- Increased wage base from $100,000.00 to $107,923.00 for Harrison Greene JEDD, Hamilton County

- Increased tax rate from 1% to 1.5%, effective 7/1/2020 for Mayfield Heights, Cuyahoga County

- Increased wage base from $100,000.00 to $101,700.00 for McAlister's JEDD, Hamilton County

- Increased tax rate from 1% to 1.1%, effective 7/1/2020 for Paulding, Paulding County

- Increased wage base from $100,000.00 to $104,039.00 for UDF North Bend JEDD, Hamilton County

- Pennsylvania tax updates include:

- Eliminated non-resident tax rate of .5% for Bethel Township, Fulton County

- Increased non-resident tax rate from 1.85% to 2%, effective 7/1/2020 for Hazleton City, Luzerne County

- Added resident tax rate of .5% and non-resident tax rate of 1 % for Jefferson Boro, York County

- Added Spring Grove Area S.D. (67670) with a tax rate of .5% for Jefferson Boro, York County

- Changed Mechanicsburg ASD PSD Code from 210699 to 210604

- Increased non-resident tax rate from 1% to 1.5% for Manns Choice Boro, Bedford County

- Added non-resident tax of 1% for Sugar Notch Boro, Luzerne County

- Added non-resident tax rate of 1% for West Hempfield Township, Lancaster County

- West Virginia tax updates include:

- Increased City Service Fee from $1.00 per week to $1.50 per week effective 7/1/2020 for Montgomery, Fayette County and Kanawha County

- Increased annual maximum City Service Fee from $52.00 to $78.00 per year effective 7/1/2020 for Montgomery, Fayette County and Kanawha County

Congratulations! You've made it to the end of the release notes. Like what you read? Click the thumbs up below.