Accessing Jurisdiction Employer ID Setup

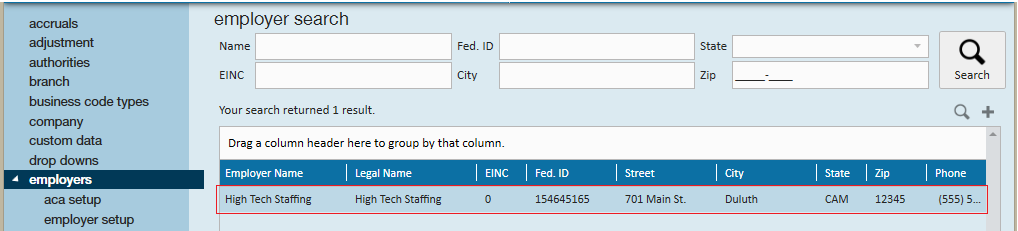

Step 1: From the (1.) all options section of the navigation tree select (2.) administration. Once there, select (3.) employers.

Step 2: Double click on the entity (company) that you would like to update Jurisdiction Employer ID information in:

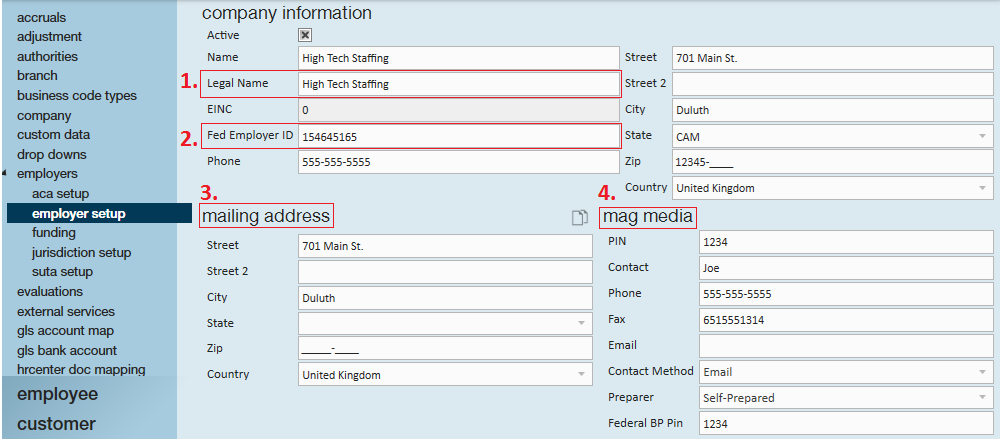

Doing so will automatically navigate users to the related employer setup page:

1. Legal Name: Will be the name that appears on all W2's for this Entity

2. Fed Employer ID: Will be the ID on all W2's for this Entity

3. Mailing Address: Will be the return address on all W2's for this Entity

4. Mag Media: Will be in the Federal SSA W2 File

Step 3: Navigate to the "Jurisdiction Setup" page within the "employers" section. Select the + icon to add a new jurisdiction, or the pencil icon to edit an existing jurisdiction.

Editing a jurisdiction:

Double click a line item, or select the pencil icon to open the "edit tax jurisdiction" window:

*Note* Existing jurisdictions may not appear in the jurisdiction list. If you select the plus icon and type in a juris for which you already have an employer id, the employer id will prefill with the existing ID. All you will need to do is fill in the other required fields and save and it will appear in Enterprise moving forward.

Pay method, pay frequency, and filing method (all required) are informational fields only so you can fill it in with your actual information or if you unsure you can pick anything and save and it won't have any negative impact.

1. Employer Identification Number: Will be the number that appears on W2's (box 15) and on the state and SUTA applicable wage reporting.

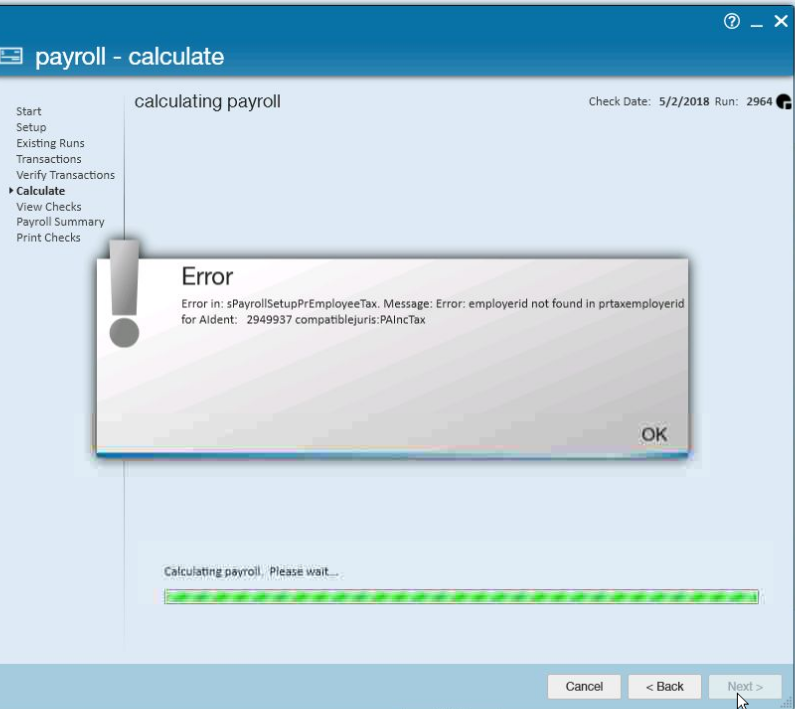

Common Related Payroll Error

Below is a common payroll error that you may have seen from time to time. While this error may look intimidating it can generally be resolved by updating an inaccurate address, or adding a Jurisdiction Employer ID into the Administration section.

Error in: sPayrollSetupPrEmployeeTax. Message: Error: employerid not found in prtaxemployerid for Aident: (insert employee ID here) compatiblejuris: (insert jurisdiction missing its employer ID in jurisdiction set up here)

What does this error mean?

Compatible tax jurisdictions for payroll are determined based on the state/zip code of the employee's permanent residence as well as the state/zip code of the worksite for the assignment the employee is currently having payroll processed for. If the compatible jurisdiction that is determined has not yet been set up in the Administration section, then this error will occur as the jurisdiction set up is needed in order to calculate taxes for the employee's paycheck.

Before adding the jurisdiction into the Adminstration section, you should verify that the state/ zip code of the employee's permanent address and assignment worksite is accurate. Otherwise, the incorrect jurisdictions may pull taxes out of the employee's check.

If you have verified that the state/ zip codes are correct and you are still receiving this error, then go ahead and add the jurisdiction and employer ID into the Administration section following the steps above.

How to read this error:

- Aident: 2949937 - tells you which employee is causing the error.

- You can use this ID to search for the employee to verify their state/ zip code of their permanent address and locate the state/ zip code on their assignment's worksite.

- CompatibleJuris: PAIncTax - tells you what jurisdiction is missing based on the current set up

- Sometimes, the jurisdictions are named differently in the Administration section than what they are labeled in the error. If you are unable to locate this jurisdiction in the drop down to add a new jurisdiction, this may be the case. In the reports section of Enterprise, there should be a Tax List report that can allow you to search by state to determine what the jurisdictions other name may be in the drop down.

- If you are still unable to find the jurisdiction in the drop down in Administration > Employers > Jurisdiction Set Up feel free to call in to Tempworks for support.