Undo an invoice correction may be utilized if an invoice has already been corrected and you wish to undo that "correction".

*Note* Keep in mind that undoing these corrections may effect your Accounts Receivable and General ledger. We recommend contacting support if you are unsure if a correction should be undone.

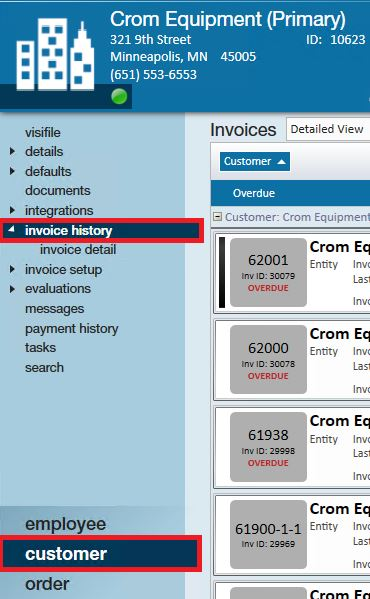

- Find the invoice that needs correcting

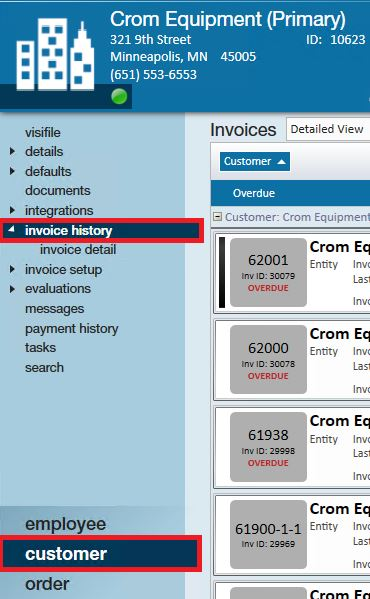

- Invoice can be found on the customer record under invoice history

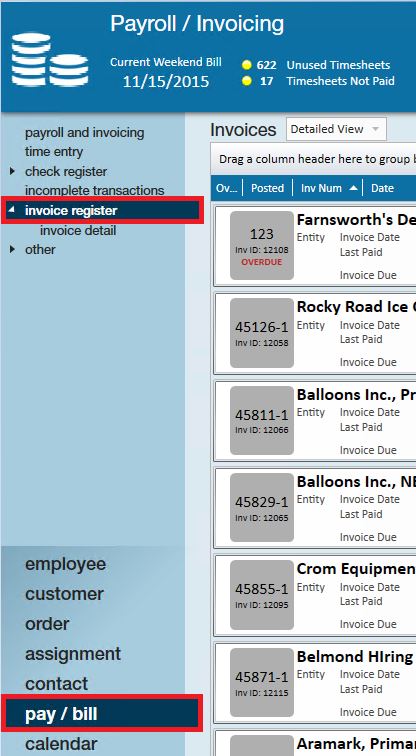

- Or you can find Invoices under Pay/Bill > Invoice Register on the left

- Invoice can be found on the customer record under invoice history

- Select the invoice correction that should be undone by double clicking to open it.

- *Note* The invoice correction will typically be a -1 invoice, meaning, it will display the original invoice number with a -1 behind it. Also, there will be a -1 for each time the invoice was corrected.

- It is recommended to undo the last correction first and work your way back to the original invoice, depending on the corrections that have been completed for this invoice and need to be removed.

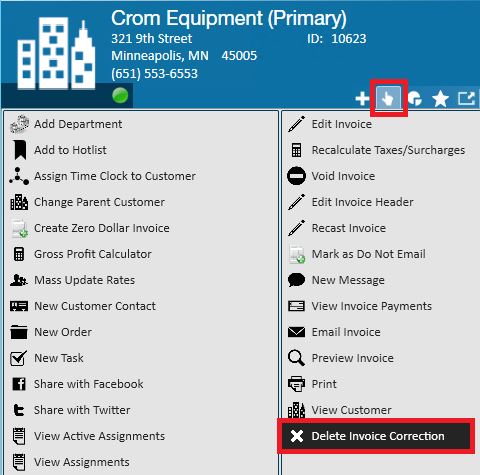

- Once the invoice correction is open select the actions button then click the option to delete invoice correction:

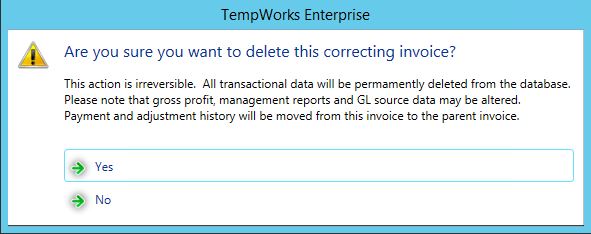

- A prompt will verify this is the action you would like to take:

- Selecting yes will delete the correction from the database.

*Note* Gross profit, management reports and gl source data may be altered by undoing a correction. Any payment and adjustment history affiliated with this invoice will be moved to the parent invoice. Select no if you would like to abandon the invoice correction undo action.

After Undoing an Invoice Correction

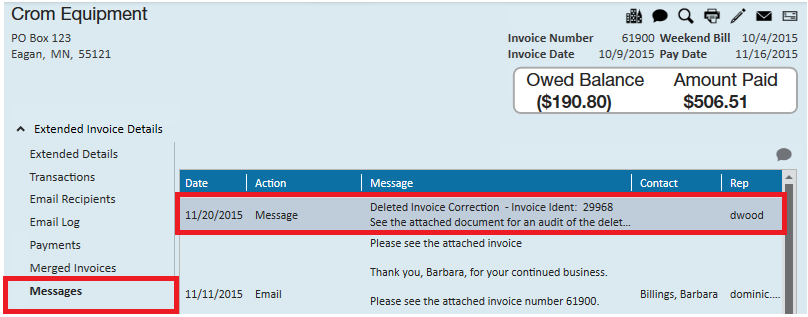

Once the deletion is complete, a message is automatically logged within the messages section of the extended invoice details noting that the invoice correction has been deleted.

Double click the message to view message details:

The message also includes an automatically generated and attached document that acts as a historical audit of the deleted invoice.

Double click the attachment to view the deleted data.