What is the IL 941 Export?

This export allows you to save a file of your Illinois 941 return for a specific date range in order to meet IL state withholding requirements. This can be run for your whole system or by EINC.

The exported file will contain employee names, SSN, Amount Taxable and Amount Taxes related to IL State Withholding. The only checks that will be pulled into this file will be for employees who have worked in IL.

This export is only available in Enterprise.

For more information check out:

How to Run the Export

*Note* We recommend running this export at your highest hierarchy (ex. System or Subsystem)

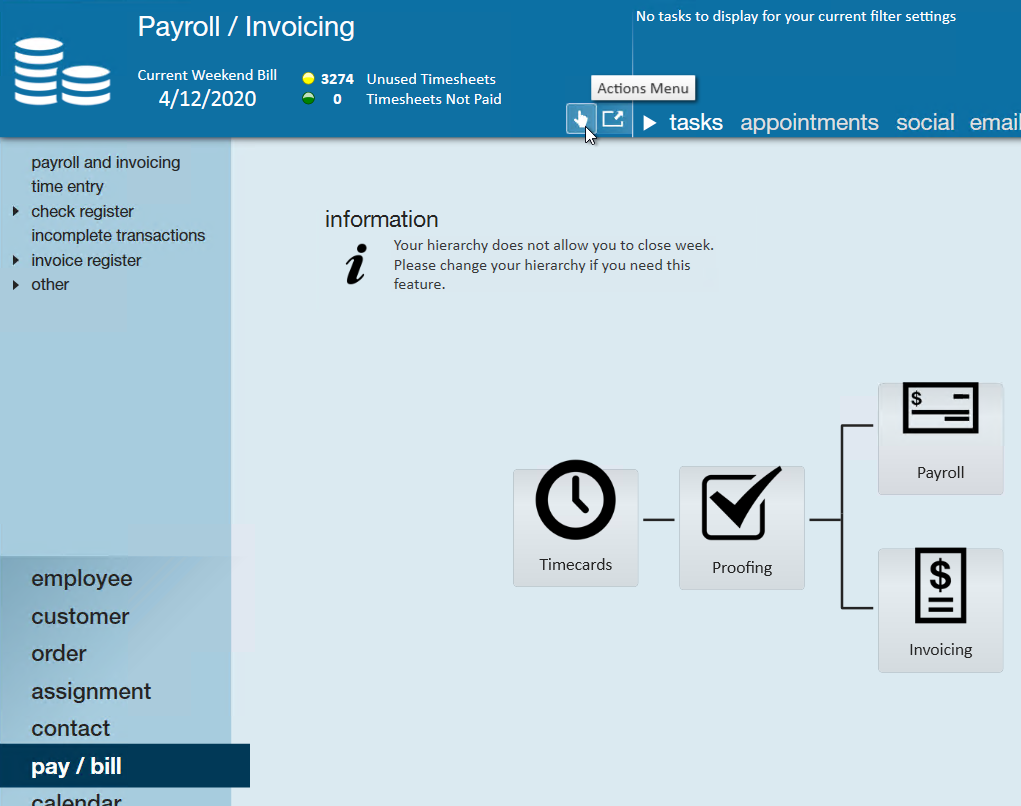

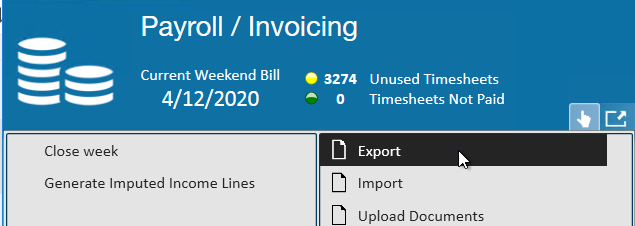

- In Enterprise, navigate to Pay/Bill

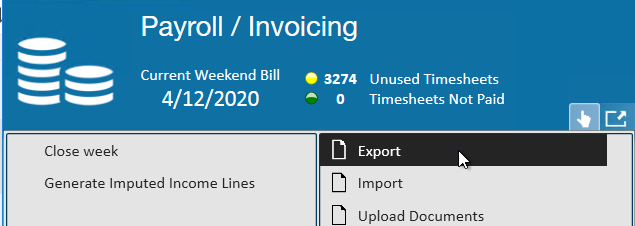

- Select the Actions Menu in the top center

- Select Export

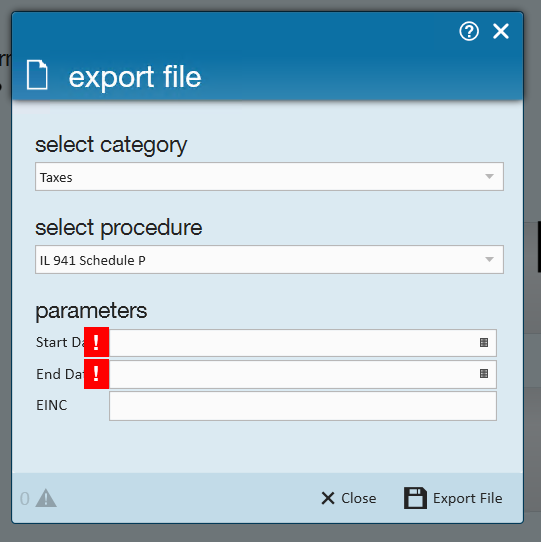

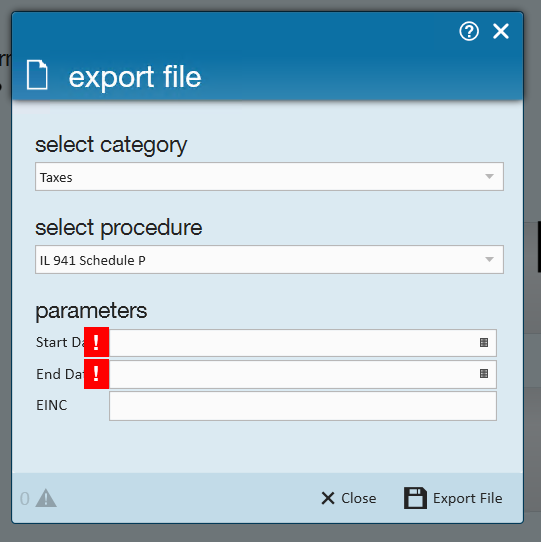

- Select the Taxes Category

- Select IL 941 Schedule P

- Enter the start and end date for the file to pull

- This date is based on check date

- Optionally, enter an EINC to ensure the file will only contain information from that EINC

- Select Export file and save to your computer

- Having a hard time finding your drives? Check out Accessing Local Drives in Enterprise