What is an Adjustment?

An adjustment is a non-taxable reimbursement or charge for an employee. This includes child support, levies, and fees etc. Adjustments that are set up on the Employee record are going to be reoccurring adjustments that may happen every week for a period of time. For adjustments such as badge fees or reimbursements, see One Time Adjustments.

*Note* Adjustment types and configurations are set up by your administration.

How to Add a Reoccurring Adjustment on an Employee Record:

- Navigate to the Employee Record you want to add an adjustment to.

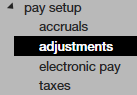

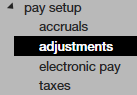

- Select pay setup > adjustments.

- Select the + icon in the upper right.

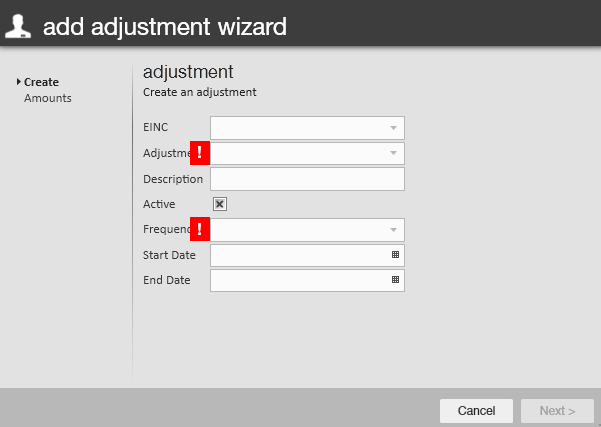

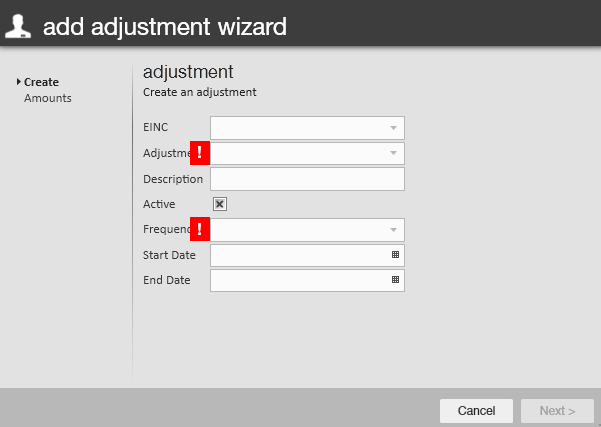

- A new window will open, enter the following information:

- Optionally, select an EINC

- Selecting an EINC (or Entity) means that the adjustment will only apply when the employee is employed to that particular EINC. This is mostly for people who have multiple lines of business, separated as entities in the system and the adjustment in question will only be applied when they work under that specific EINC.

- Select the type of adjustment.

- Adjustment types are setup by your administrator.

- Employees can only have one of each type of adjustment added.

- Enter an optional description.

- Under Frequency, enter how frequently the employee is paid.

- If the adjustment does not start until a later date, enter the start date.

- Otherwise leave it blank to start immediately.

- If the adjustment does not have an end date, leave the end date blank.

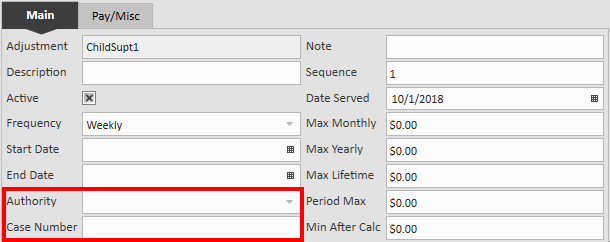

- Depending on the adjustment type selected, more fields may appear and become required.

- Ex. Child support may have a required authority field.

- Select ‘Next.’

- Optionally, select an EINC

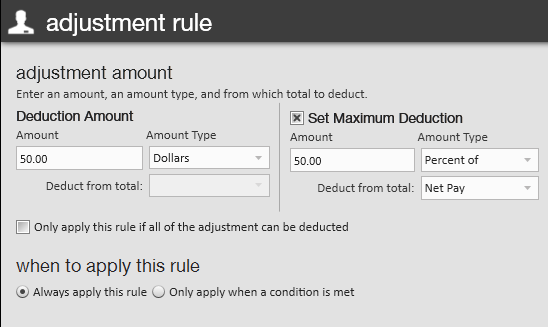

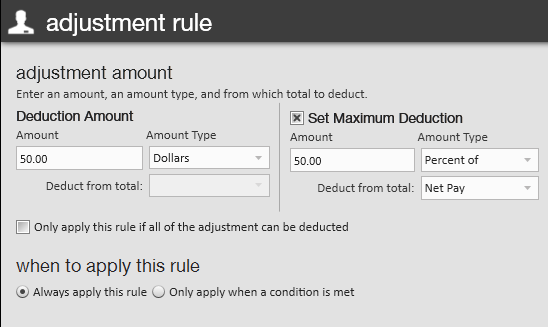

- Select the + icon to add an adjustment amount:

- Deduction Amount

- Choose an amount type (either dollars or percent of).

- Enter amount (either the dollar amount to be deducted or the % of the paycheck that should be deducted).

- Optionally, check the box next to 'Set Maximum Deduction' to set a limit to the amount that can be deducted.

- Ex. No more that 50 % of the paycheck or no more than $100 dollars

- Select ‘Save.’

- The adjustment has now been added.

Additional Questions to Consider

After adding an adjustment, there are three questions you should ask yourself:

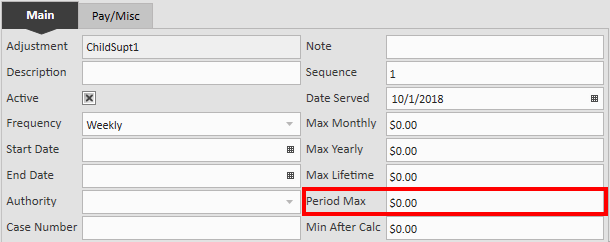

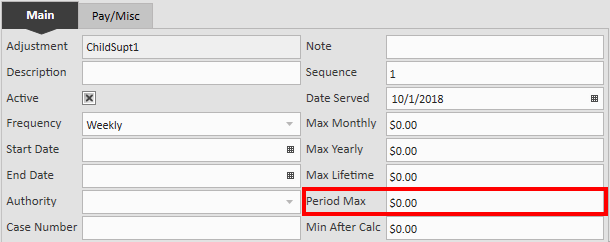

Question 1: What is the maximum that can be deducted in one pay period?

If an employee has multiple transactions in a pay period, then the adjustment will automatically deduct from each paycheck. If this is not how you want this adjustment to behave, you will want to set up a ‘period max.’

- Select the adjustment and find 'Period Max' in the lower right.

- Enter the maximum amount that can be deducted during a pay period to prevent more from being taken from additional transactions.

Question 2: Where is the money going?

Each adjustment is going to differ in where the money is being sent. For example, child support cases should have an authority and case number filled out.

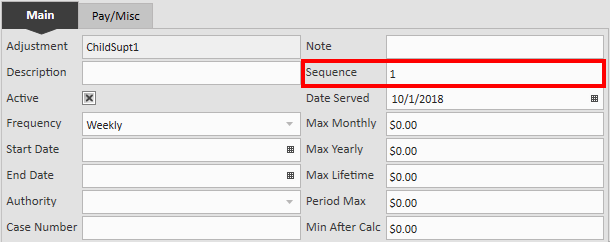

Question 3: How important is it?

If an employee has multiple adjustments, you can prioritize which adjustments are taken out first by entering a number in the sequence field.

*Note* If using multiple child support adjustments or garnishments, you may use the number in the sequence more than once. For example, you would want all the child support adjustments to have highest priority so you would enter a sequence of 1 for all child support adjustments.

Related Articles

- None