ACA Reporting

If you are using Enterprise or Beyond to track ACA information, we have a few report options for auditing, reviewing, or pulling out important information. Keep in mind that you can also create your own custom options utilizing a custom ACA Search. Check out Auditing Employee Records with ACA Searches for more information on search options available in your system.

Looking for a list of all ACA Report options available? Check out Affordable Care Act Reports Manual.

Looking for the full reports manual? Check out Full Reports Manual.

Locating ACA Reports

ACA reports are listed in their own category under all options > reports in Enterprise:

*Note* Reports in Enterprise require you to have specific security permissions. You will need to have access to the Affordable Care Act reports category in order to see or run any ACA related reports. Check out Enterprise - Security Roles for more information or talk to your admin if you are not seeing the reports you are expecting to.

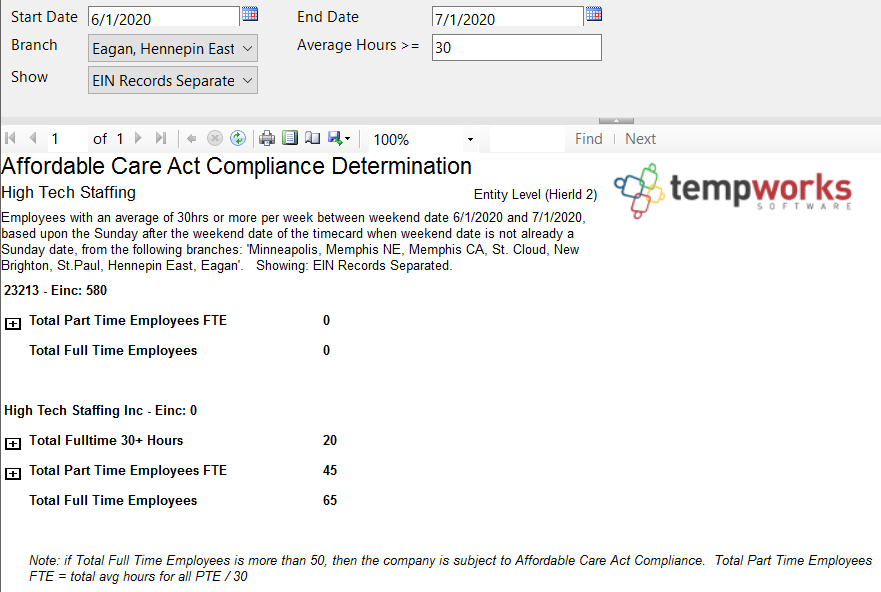

Affordable Care Act Compliance Determination

Purpose: This report is a great way to check your compliance with ACA and see the total number of employees considered full time.

Total Part Time Employees FTE is calculated by taking the sum of the weekly average amount for your PTE, who have worked an average of less than the entered hour limit amount, and dividing that sum/total by the entered hour limit amount.

This report shows you how many Full Time employees you have and if you are required to comply with the Affordable Care Act.

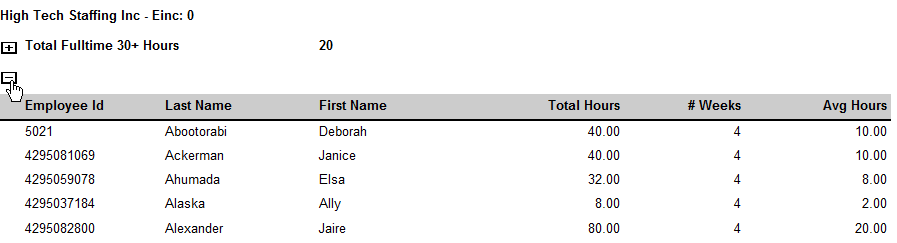

If you click on the + option next to any grouping, you will be able to expand the report to show each employee considered in that count and their total and average hours:

Parameters

| Parameter | Description |

|---|---|

| Start Date | This is the starting date the report will use to report on hours, gross pay, etc.

|

| End Date | This is the end date the report will use to gather hours, gross pay, etc. for the report. Start date + End date = date range for this report.

|

| Branch | Select which branches you want to include on this report

|

| Group By | If you would like this report to group by branch, etc. use the drop down to select the grouping option. Otherwise, leave as "no grouping." |

| Show | Select which options you want to have included on this report:

|

| Average Hours | Enter the minimum average number of hours each week that an employee must have worked to be included in this report

|