What is Master Tax?

Master Tax is a 3rd party resource to assist in payroll tax filings. There are two types of file exports (PTS & RTS) built into Enterprise which allow us to import data from Enterprise into Master Tax. This data allows you to generate returns and ACH bulk file uploads from Master Tax to complete tax filings.

*Note* This is an additional module that may be added into your database. Please work with a TempWorks representative for assistance.

How to Complete a MasterTax Export

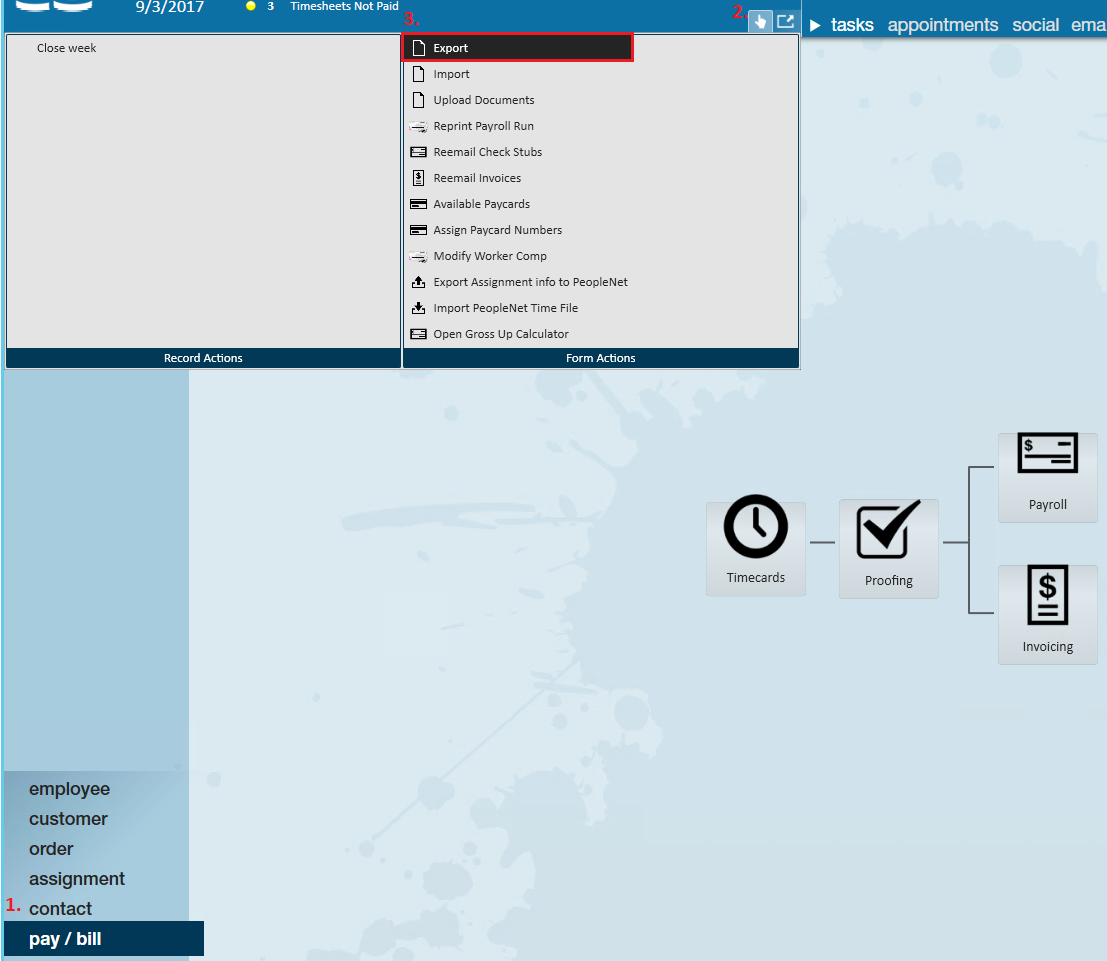

To access the MasterTax Export navigate to the 'Pay/Bill' area, then select the (1.) 'Actions' menu, from here (2.) select export (3.):

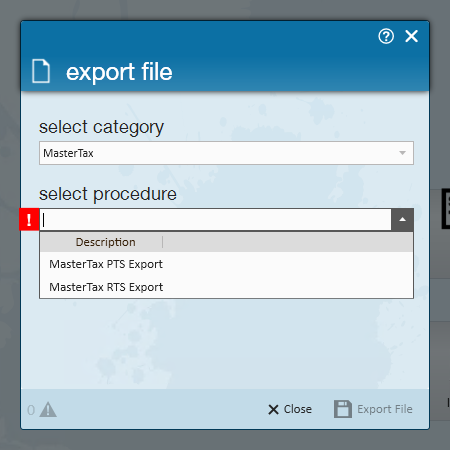

Once export is chosen, select "MasterTax" from the select category drop down. Select the export that you wish to execute (PTS or RTS):

PTS

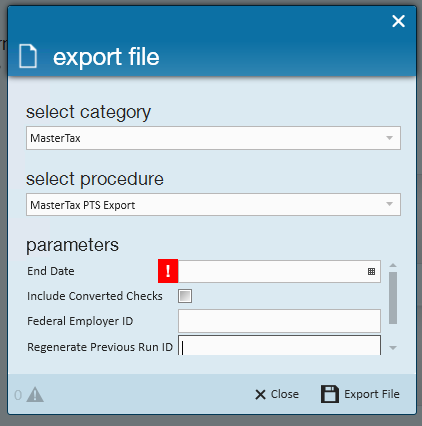

With the "MasterTax PTS Export" selected, enter/select the following:

- End Date

- Include Converted Checks

- Federal Employer ID

- Regenerate Previous Run ID

*Note* If Federal Employer ID is left blank, the export will generate data for all Employer ID's visible from the current hierarchy location.

Once the information has been entered, select "Export File".

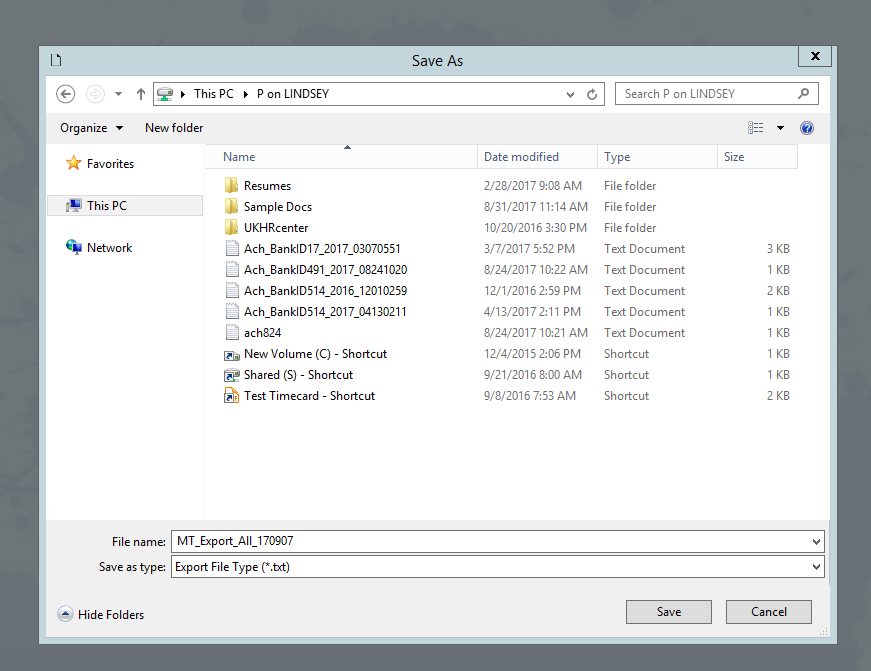

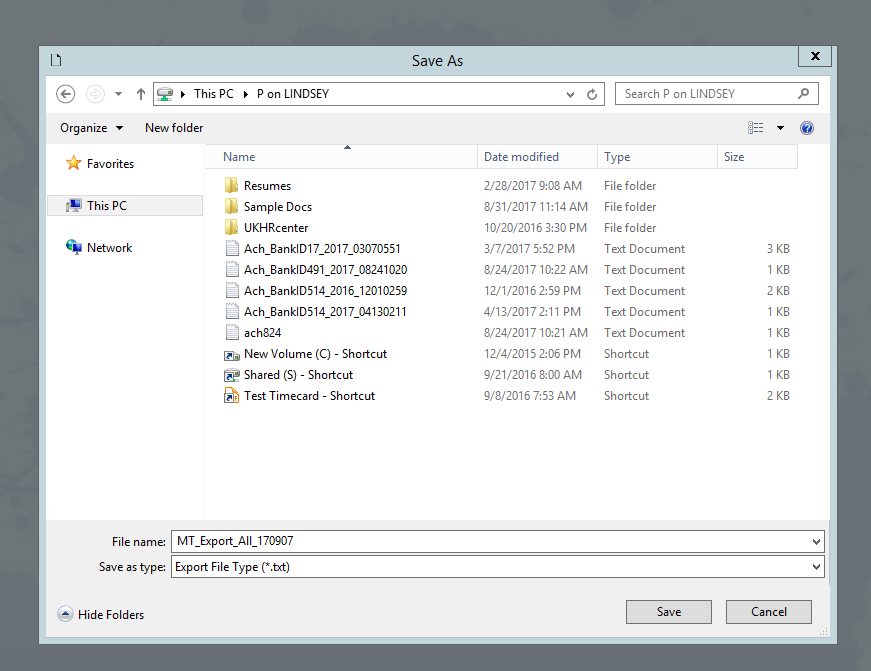

A 'Save As' dialog will appear when the data is ready. The default file name will take the form of "MT_Export_" (EmployerID) "_" (Today's Date as YYMMDD). (If Employer ID is left empty, the file name will instead default to "All".)

RTS

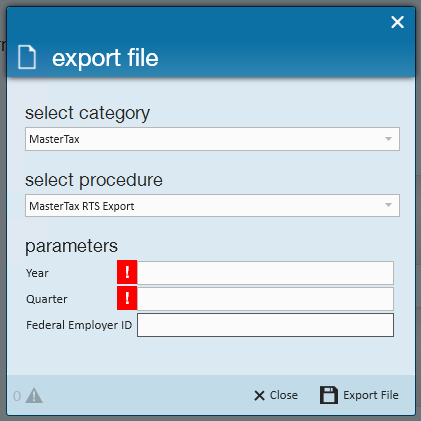

With the "MasterTax RTS Export" selected, enter/select the following:

- Year

- Quarter

- Federal Employer ID

*Note* If Federal Employer ID is left blank, the export will generate data for all Employer ID's visible from the current hierarchy location.

Once the information has been entered, select "Export File".

A 'Save As' dialog will appear when the data is ready. The default file name will take the form of "MT_Export_" (EmployerID) "_" (Today's Date as YYMMDD). (If Employer ID is left null, the file name will instead default to "All".)